Decoding the Adjuster Dilemma: Who's on Your Side?

After property damage, navigating insurance claims can be stressful. A crucial decision is choosing between a public adjuster vs insurance adjuster. This listicle clarifies the seven key differences, empowering Oregon and Washington homeowners, business owners, municipalities, and non-profits to secure optimal settlements. Understanding these distinctions is vital for maximizing your claim payout after fire, flood, storm, or vandalism. Learn about roles, payment, expertise, timelines, legal frameworks, communication, and when to hire each type of adjuster.

1. Role and Representation Differences

The most fundamental difference between a public adjuster and an insurance adjuster lies in who they represent. This distinction is crucial to understand before navigating the often complex world of insurance claims. Choosing the right type of adjuster can significantly impact your final settlement and the overall claims process. This section clarifies the roles of both types of adjusters, outlines their respective advantages and disadvantages, and empowers you to make informed decisions when dealing with property damage and insurance claims.

Public adjusters work solely for the policyholder—you—acting as your advocate throughout the entire claims process. Their primary goal is to maximize your insurance settlement, ensuring you receive the full benefits entitled to you under your policy. They handle everything from documenting the damage and preparing detailed estimates to negotiating directly with the insurance company on your behalf. Think of them as your expert representative in the claims arena.

Conversely, insurance adjusters, often referred to as company adjusters or staff adjusters, are employed by or contracted with insurance companies. Their role is to assess the damage to your property and determine the appropriate payout from the insurance company's perspective. While they are obligated to handle claims fairly, their ultimate responsibility is to protect the insurer's financial interests. This inherent conflict of interest can sometimes lead to lower settlement offers than what a policyholder might rightfully deserve.

Both public and insurance adjusters must be licensed in most states, including Oregon and Washington, to practice. However, their payment structures differ significantly. Public adjusters typically work on a contingency fee basis, receiving a percentage (usually between 5-20%) of the final settlement amount. This means they only get paid if you get paid. Insurance adjusters, on the other hand, receive salaries or fees directly from the insurance company, regardless of the settlement outcome.

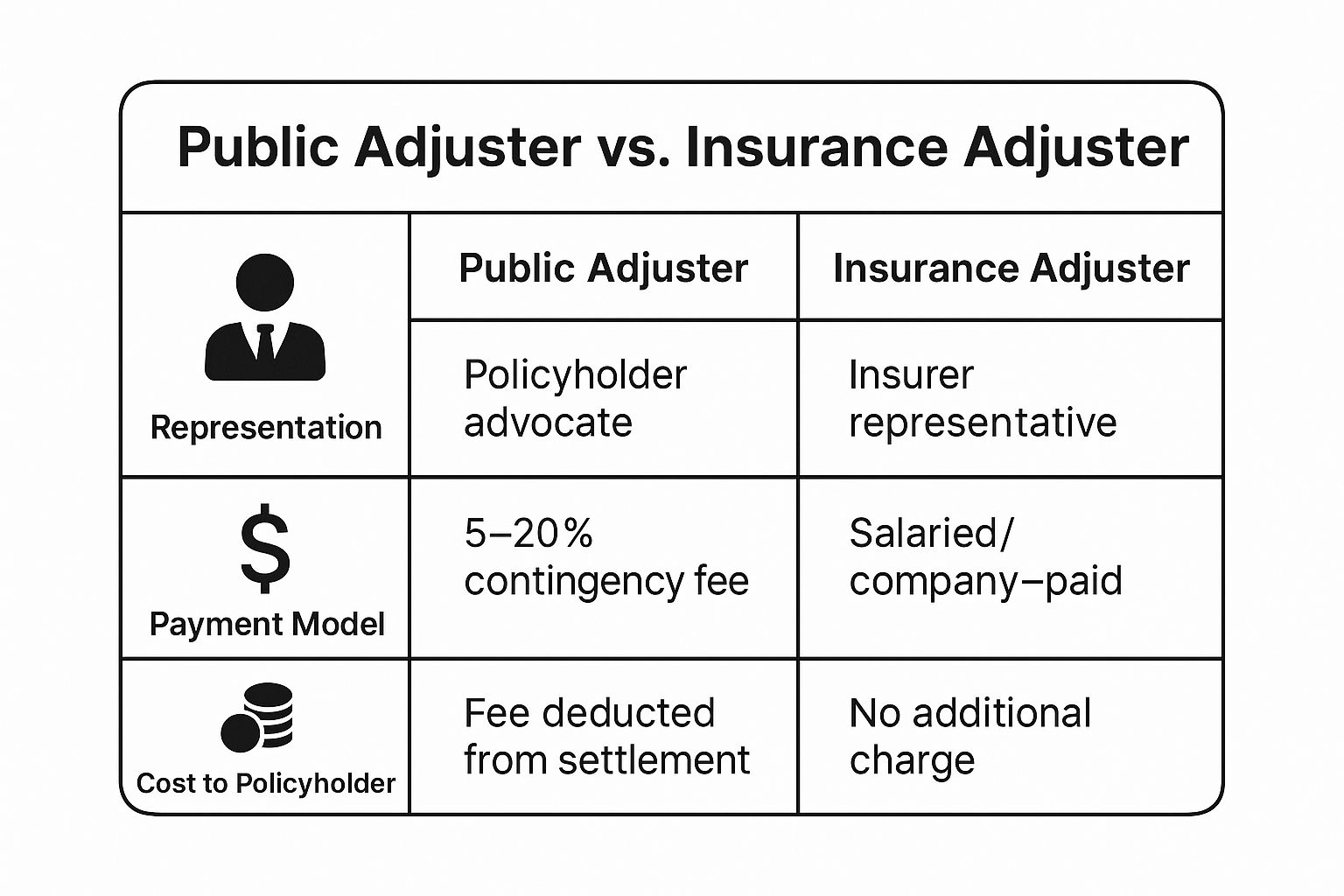

The following infographic summarizes these key differences:

As this quick reference illustrates, the core difference lies in representation and payment structure, influencing each adjuster's motivation throughout the process. Understanding this is the first step in deciding which type of adjuster best suits your needs.

So, when should you consider hiring a public adjuster? While insurance adjusters are readily available at no additional cost and offer familiarity with company procedures, their inherent bias towards the insurer can be detrimental, especially in complex or high-value claims. Public adjusters are particularly beneficial in situations involving significant property damage, intricate policy language, or disputes with the insurance company. They level the playing field, providing the expertise and dedicated advocacy needed to secure a fair and maximized settlement. For example, after the devastating wildfires in Oregon, many homeowners found themselves overwhelmed by the claims process. Public adjusters proved invaluable in helping these individuals navigate the complexities, accurately assess the damage, and negotiate equitable settlements with insurance companies.

However, it's crucial to be aware of the potential drawbacks. Public adjusters do charge a commission, which can reduce your net settlement amount. Additionally, their involvement might extend the claims processing time. Conversely, while insurance adjusters handle claims at no extra cost and may process them faster, they might not pursue the maximum possible payout for you. Examples abound where policyholders, relying solely on insurance adjusters, received significantly lower settlements compared to those who employed public adjusters, especially after catastrophic events like floods or major storms impacting Washington businesses.

Here are some actionable tips for navigating the adjuster landscape:

- Understand Representation: Before signing any agreements, clarify who the adjuster represents and their obligations.

- Research and Verify: Investigate the adjuster's track record, licensing status, and client reviews.

- Complex Claims = Public Adjuster: For high-value or complex claims, particularly those involving extensive damage or disputes, strongly consider engaging a public adjuster.

- Document Everything: Maintain meticulous records of all interactions and correspondence with any adjuster handling your claim. This documentation will be invaluable throughout the process.

Choosing the right adjuster is a pivotal decision in the aftermath of property damage. By understanding the distinct roles and responsibilities of public adjusters and insurance adjusters, and weighing the pros and cons of each, you can confidently navigate the claims process and secure the compensation you deserve.

2. Payment Structure and Fee Models

Understanding the financial implications of hiring a public adjuster versus relying on an insurance company's adjuster is crucial for making informed decisions during the claims process. This aspect significantly impacts not only your potential recovery but also the overall dynamics of how your claim is handled. The core difference lies in who pays the adjuster and how that payment is structured. This seemingly simple distinction creates contrasting incentives that directly affect how each type of adjuster approaches your claim.

Public adjusters operate on a contingency fee basis, meaning their compensation is directly tied to the success of your claim. They typically charge a percentage of the final settlement amount, usually ranging from 5% to 20%. This "no recovery, no fee" structure incentivizes them to negotiate aggressively on your behalf to maximize your payout. In contrast, insurance adjusters are salaried employees of the insurance company or are paid by the company on an hourly or per-claim basis. Their compensation isn't linked to the amount you receive, which can sometimes create a conflict of interest. Their primary goal is often to minimize the insurance company's payout, potentially leading to lower settlements for policyholders. This fundamental difference in payment models is at the heart of the "public adjuster vs. insurance adjuster" debate.

This payment structure distinction becomes even more critical when considering the complexity and potential value of your claim. For substantial losses, such as those resulting from widespread hurricane damage or a major commercial fire, the percentage-based fee for a public adjuster might be justified by a significantly increased settlement. However, for smaller claims, the contingency fee might eat into a larger portion of the final payout, potentially negating the benefits. Furthermore, state laws regulate public adjuster fees, often imposing caps on the percentage they can charge. Oregon and Washington residents, for instance, should be aware of their respective state regulations concerning these fee limits.

Examples of how this difference plays out in real-world scenarios:

-

Hurricane Damage: Imagine a homeowner in Oregon whose initial insurance offer for hurricane damage is $50,000. A public adjuster, after thoroughly assessing the damage and negotiating with the insurance company, manages to secure a $150,000 settlement. With a 15% contingency fee, the adjuster would receive $22,500, leaving the homeowner with a net settlement of $127,500 – a substantial increase despite the fee.

-

Commercial Fire Loss: A business owner in Washington experiences a devastating fire. The insurance company initially offers $800,000. A public adjuster, leveraging their expertise in commercial property claims, negotiates a $2 million settlement. Even with a 10% fee ($200,000), the business owner receives $1.8 million, a significantly higher amount than the initial offer.

-

Water Damage Claim: In some cases, insurance adjusters may process straightforward claims more quickly. A simple water damage claim might be handled in 30 days by an insurance adjuster, while a public adjuster, focusing on maximizing the claim value, might take 90 days. This time difference illustrates the varying priorities of each type of adjuster.

Navigating the Fee Structures – Actionable Tips:

- Negotiate: Don’t hesitate to negotiate the public adjuster’s fee before signing any contracts. While state regulations provide upper limits, there's often room for negotiation, especially for larger claims.

- Compare: Weigh the potential increase in your settlement against the adjuster’s fee. For smaller claims, the fee might outweigh the potential benefits. Use online calculators or consult with financial advisors if needed.

- Understand the Fine Print: Ensure you fully understand the fee structure, including any expenses or additional costs beyond the percentage-based fee.

- Research State Regulations: Familiarize yourself with your state's regulations on maximum allowable fees for public adjusters. This knowledge protects you from excessive charges and ensures a fair agreement.

Choosing between a public adjuster and relying on the insurance company's adjuster requires careful consideration of your specific circumstances. The payment structure is a critical factor. By understanding the nuances of these fee models and following the tips outlined above, you can make a well-informed decision that aligns with your needs and maximizes your potential recovery.

3. Expertise and Specialization Areas

When navigating the complexities of an insurance claim, the specific expertise of the adjuster you choose can significantly impact the outcome. A key difference between public adjusters and insurance adjusters lies in their areas of specialization and how those specializations ultimately benefit their respective clients. Understanding these differences is crucial for policyholders deciding which type of adjuster best suits their needs. Public adjusters and insurance adjusters often carve distinct professional niches based on their roles and the parties they represent. This specialization can be the deciding factor in the success of your claim. By carefully considering the type of loss you've experienced and matching it to the expertise of the adjuster, you can greatly improve your chances of receiving a fair and just settlement.

Public adjusters typically dedicate their careers to maximizing claim values for policyholders. They develop a deep understanding of insurance policy language, specifically interpreting it from the policyholder's perspective, not the insurance company's. This often leads them to specialize in particular types of losses, such as hurricane damage, fire claims, water damage restoration, or commercial property losses. They may even further specialize within these categories, focusing on specific aspects like business interruption claims within commercial losses, or high-value residential rebuilds after fire damage. This focused approach allows them to develop an unparalleled level of expertise in their chosen area. Learn more about Expertise and Specialization Areas if you're an Oregon homeowner looking for specialized public adjusting services.

Conversely, insurance adjusters, also known as company adjusters, are employed by the insurance company. Their focus is on accurate claim evaluation from the insurer's perspective, fraud detection, and efficient claims processing within the company's guidelines. While they might handle a broader range of claim types compared to a public adjuster, their expertise is often spread across numerous areas, potentially diluting their specialization in any single type of loss. They are well-versed in company-specific procedures, software, and internal rules, which streamlines the processing of more routine claims.

Both public and insurance adjusters must engage in continuing education to maintain their licenses and stay up-to-date on industry changes, but the direction of that education often differs based on their respective roles.

Pros of Specialized Expertise:

- Public Adjusters: Deep expertise in maximizing specific claim types leads to potentially higher settlements. Specialized public adjusters often possess intricate knowledge of complex commercial policies and can effectively negotiate on behalf of businesses. For instance, a commercial property public adjuster specializing in business interruption claims can accurately assess the financial impact of a disruption and advocate for appropriate compensation.

- Insurance Adjusters: Broad knowledge across multiple loss categories allows for efficient handling of common claims. This streamlined processing is particularly beneficial for routine claims like minor auto accidents, where specialized expertise may not be as critical. Their familiarity with the company's systems and procedures often leads to quicker processing times.

Cons of Specialization:

- Public Adjusters: May lack broad experience in uncommon or niche claim types. Over-specialization can create knowledge gaps in other areas of insurance.

- Insurance Adjusters: Might not possess the in-depth knowledge necessary for highly complex or catastrophic losses. Some insurance adjusters may overestimate their expertise when faced with unfamiliar claim types, potentially leading to undervaluation of a claim.

Examples of Successful Specialization:

- Hurricane specialist public adjusters in Florida have demonstrated significant success, sometimes achieving settlements up to 300% higher than initial offers.

- Public adjusters with engineering backgrounds specializing in fire damage assessment can provide detailed structural analyses, leading to more accurate and comprehensive claims.

- Insurance adjusters specializing in auto claims process thousands of claims annually, efficiently handling high volumes of routine cases.

Tips for Choosing the Right Adjuster:

- Match Expertise to Your Loss: Consider the specifics of your loss. A complex commercial claim requires a different skill set than a straightforward residential claim.

- Inquire About Experience: Ask potential adjusters about their relevant experience and successful case histories in handling similar claims. Don't hesitate to request references.

- Verify Credentials: Check for specialized certifications or training that demonstrate expertise in your specific type of loss.

- Complex Claims Need Specialists: For high-value or complex claims, prioritize specialized expertise over general knowledge.

By understanding these nuances of specialization within the adjusting field, policyholders can make informed decisions and secure the best possible representation for their unique situations. Whether you’re a homeowner navigating a fire claim, a business owner facing a complex business interruption scenario, or a municipality dealing with the aftermath of a natural disaster, selecting an adjuster with the right expertise can be the key to a successful claim resolution.

4. Claims Process Timeline and Efficiency

When disaster strikes, the clock starts ticking. Understanding the timeline for your insurance claim, and how the involvement of a public adjuster vs. an insurance adjuster impacts that timeline, is crucial for effective recovery. The efficiency of the claims process differs significantly depending on who is handling your claim, impacting both the speed and the final settlement amount. This distinction often makes all the difference in a policyholder's ability to rebuild their lives or businesses. A seemingly simple choice between speed and thoroughness can have substantial financial implications.

Insurance adjusters, working for the insurance company, operate within established procedures and have direct access to internal systems. This allows them to process claims relatively quickly. They typically complete initial property inspections within 7-14 days and can often approve settlements for straightforward claims within a few weeks. This speed can be a significant advantage for policyholders facing urgent repair needs. However, this efficiency can sometimes come at the cost of thoroughness. Insurance adjusters are incentivized to settle claims quickly and efficiently for their employer – the insurance company. This can lead to overlooked damage or undervalued settlements, leaving policyholders with less than they are entitled to under their policy.

Public adjusters, on the other hand, work exclusively for you, the policyholder. Their focus is on maximizing your claim payout. They conduct comprehensive investigations, often taking 2-4 weeks, meticulously documenting all damage, including hidden or initially overlooked issues. They understand policy intricacies and advocate aggressively on your behalf, often negotiating multiple rounds with the insurance company to reach a fair settlement. This thorough approach frequently results in significantly higher payouts, justifying the additional time investment. However, involving a public adjuster can extend the overall settlement timeline by 30-60 days or more, depending on the complexity of the claim.

State regulations mandate specific response timeframes for both insurance and public adjusters, ensuring a degree of accountability in the process. However, the actual timeline can vary widely based on the complexity of the damage, the type of policy, and the responsiveness of the insurance company. For example, a simple water damage claim might be settled in 21 days with an insurance adjuster, while a complex hurricane claim could take six months with a public adjuster, ultimately yielding a $500,000 settlement compared to the initial $150,000 offer from the insurance company. Similarly, a commercial fire claim resolved in 45 days with an insurance adjuster might take four months with a public adjuster, but potentially result in a substantially higher settlement. Even a seemingly straightforward hail damage claim could see an increase from $8,000 to $35,000 over a 3-month public adjuster process.

Choosing between a public adjuster and relying solely on the insurance company’s adjuster is a critical decision. Consider your financial situation. Can you withstand a potentially longer claims process with a public adjuster to potentially receive a higher settlement? Or is the urgency of immediate repairs paramount? Understanding typical timelines for your specific claim type is essential. Learn more about Claims Process Timeline and Efficiency for a deeper understanding of the process.

Before making a decision, ask both insurance and public adjusters about their expected milestones and communication schedules. Weigh the urgency of repairs against the potential for a significantly higher settlement. For homeowners in Oregon and Washington, business owners navigating complex commercial claims, or anyone feeling overwhelmed by the insurance process after fire, flood, storm, or vandalism, a public adjuster can provide expert guidance and advocacy. Ultimately, balancing the need for timely repairs with the potential for maximizing your insurance payout is key to a successful recovery. This is particularly crucial for municipalities, schools, and nonprofit organizations that often face complex claims processes with potentially significant financial implications. Choosing the right path, whether relying on an insurance adjuster or engaging a public adjuster, is a critical step in navigating the aftermath of property damage.

5. Legal and Regulatory Framework: Navigating the Landscape of Insurance Claims

Understanding the legal and regulatory framework governing both public adjusters and insurance adjusters is crucial for policyholders navigating the often complex world of insurance claims. This knowledge empowers you to make informed decisions, protect your rights, and ensure you receive a fair settlement. This section explores the regulations surrounding both types of adjusters, highlighting the importance of these frameworks in maintaining ethical conduct and professional standards.

Both public adjusters and insurance adjusters operate within a legal and regulatory structure that varies by state. These regulations are designed to protect consumers and ensure a level playing field in the claims process. This framework dictates licensing requirements, ethical guidelines, fee structures, and permissible practices, creating a system of accountability for both types of adjusters.

Public Adjusters: Advocates for the Policyholder

Public adjusters work exclusively for the policyholder, representing their interests throughout the claims process. Their licensing and regulation are stringent, aimed at ensuring they possess the necessary knowledge and ethical grounding to effectively advocate for their clients. Key aspects of public adjuster regulation include:

- Licensing by State Insurance Departments: All states require public adjusters to be licensed. This process typically involves completing pre-licensing education, passing an examination, and undergoing a background check. For instance, Florida mandates a 40-hour pre-licensing course, demonstrating the commitment to establishing a baseline of competency.

- Continuing Education Requirements: Maintaining a license usually necessitates ongoing continuing education. This ensures public adjusters stay abreast of evolving industry practices, regulations, and policy changes.

- Ethical Guidelines and Prohibitions: Stringent ethical guidelines govern public adjuster conduct. These guidelines address conflicts of interest, prohibit certain practices like soliciting claims immediately after a disaster (as seen in Texas with its 72-hour post-disaster solicitation ban), and establish standards for professional behavior.

- Fee Structures and Contract Regulations: State regulations often govern how public adjusters structure their fees and contracts with clients. California, for example, caps public adjuster fees at different rates depending on the type of claim. These regulations aim to protect consumers from excessive or unfair charges.

- Surety Bond Requirements: Some states require public adjusters to obtain a surety bond. This bond acts as a form of financial protection for consumers, ensuring they can be compensated if the adjuster engages in fraudulent or unethical practices. New York, for example, mandates a $100,000 surety bond for public adjuster licenses.

Insurance Adjusters: Representing the Insurer

Insurance adjusters, whether staff adjusters employed directly by the insurance company or independent adjusters contracted by the insurer, represent the interests of the insurance company. While they are bound by regulations requiring fair claims practices and ethical conduct, their primary responsibility is to assess the damage and determine the insurer’s liability. Key regulatory aspects for insurance adjusters include:

- Licensing Requirements: Most states require insurance adjusters to be licensed, though the specific requirements vary. They may be licensed as staff adjusters, independent adjusters, or even hold a public adjuster license.

- Regulations Governing Fair Claims Practices: Adjusters must adhere to state regulations designed to ensure fair and prompt handling of claims. These regulations address issues such as timely investigations, proper communication with policyholders, and adherence to prompt payment laws.

- Ethical Conduct Standards: Insurance adjusters are expected to uphold ethical standards, including avoiding misrepresentation of policy provisions and acting in good faith throughout the claims process.

Why Understanding the Regulatory Framework Matters

The regulatory framework surrounding both public and insurance adjusters is essential for several reasons:

- Consumer Protection: These regulations provide a layer of protection for policyholders, ensuring a minimum level of competency and ethical conduct from both types of adjusters.

- Transparency and Accountability: The framework establishes clear guidelines for adjuster practices, promoting transparency and accountability in the claims process.

- Enforcement and Recourse: Regulatory oversight enables disciplinary actions against adjusters who violate regulations or ethical guidelines, providing recourse for policyholders who have been treated unfairly.

Actionable Tips for Policyholders:

- Verify Licensing: Always verify the licensing status of any adjuster you are considering hiring through your state insurance department's website.

- Understand State Regulations: Familiarize yourself with your state's specific regulations regarding adjuster practices. This knowledge will help you understand your rights and what to expect during the claims process.

- Report Violations: Report any suspected violations of ethical guidelines or regulations to the appropriate regulatory authorities.

- Review Contracts Carefully: Carefully review any contract offered by a public adjuster, ensuring it complies with state regulatory requirements regarding fee structures and other provisions.

By understanding the regulatory landscape, you can navigate the insurance claims process with confidence, knowing your rights are protected and that both public and insurance adjusters are held to a defined standard of professional conduct. This knowledge is invaluable in ensuring a fair and equitable outcome for your claim.

6. Communication and Advocacy Approach: Understanding Who's on Your Side

When dealing with the aftermath of property damage, clear and effective communication is paramount. Understanding the different communication styles and advocacy approaches of public adjusters versus insurance adjusters is crucial for navigating the often-complex claims process. This distinction can significantly impact your settlement and your overall experience. Choosing between a public adjuster vs insurance adjuster requires carefully considering who is truly advocating for your best interests.

A public adjuster works exclusively for you, the policyholder. They act as your dedicated advocate, ensuring your voice is heard and your claim is fully maximized. Their communication is frequent and transparent, keeping you informed every step of the way. They explain complex policy language in plain English, breaking down technical jargon and ensuring you understand your rights and coverage. They fight for the maximum settlement you deserve, leveraging their expertise and knowledge of insurance policies to negotiate effectively with the insurance company. Think of them as your personal insurance expert, guiding you through the entire process, from filing the initial claim to finalizing the settlement.

Conversely, an insurance adjuster works for the insurance company. While they will communicate with you about your claim, their primary loyalty is to their employer. This can influence how they present options and settlements, often focusing on efficient claim processing and minimizing the payout. Their communication, while often prompt for routine matters, may not fully explore all possible avenues for maximizing your claim. They will explain the company’s requirements and procedures clearly, but their focus is on adhering to company guidelines and controlling costs.

This difference in loyalty manifests in several key aspects of communication:

- Frequency and Detail: Public adjusters typically provide more frequent updates and more detailed explanations throughout the claims process, often providing weekly or even daily updates during complex claims like those involving hurricanes or extensive fire damage. Insurance adjusters, on the other hand, may communicate less frequently, primarily at key milestones in the claim process.

- Advocacy and Education: Public adjusters proactively educate policyholders about their rights and options, empowering them to make informed decisions. They explain policy nuances, such as business interruption coverage for commercial property owners or additional living expenses for displaced homeowners, ensuring you understand the full extent of your potential recovery. Insurance adjusters focus on explaining the company's position and the steps required for processing the claim, but may not proactively explore all possible coverage options available to the policyholder.

- Focus: Public adjusters focus on maximizing your claim and ensuring you receive a fair settlement. They meticulously document damages, negotiate with the insurance company, and handle all the paperwork involved in the process. Insurance adjusters focus on efficiently processing the claim within company guidelines and may not dedicate the same level of resources to maximizing individual settlements.

Examples of these differing approaches in action:

- Public Adjuster: A public adjuster representing a business owner after a fire meticulously documents all lost inventory and equipment, educates the owner about business interruption coverage, and negotiates with the insurance company to secure a settlement that covers both the physical damage and the lost income. They provide weekly updates throughout the multi-month process, keeping the business owner informed and engaged.

- Insurance Adjuster: An insurance adjuster handling a residential homeowner's water damage claim explains the company’s procedures for submitting repair estimates and outlines the covered perils under the policy. They respond promptly to questions about the deductible and depreciation but may not proactively explain potential additional living expense coverage or explore the full extent of damage hidden within walls or flooring.

Tips for Effective Communication with Adjusters:

- Establish Clear Expectations Upfront: Discuss communication preferences and schedules with the adjuster at the beginning of the process.

- Get it in Writing: Request written explanations of any decisions, recommendations, or claim denials. This creates a clear record and allows you to review the information thoroughly.

- Understand the Adjuster’s Role: Keep in mind the adjuster's employer and how that may influence their advice and decisions.

- Ask Questions: Don't hesitate to ask questions about your policy coverage, the claims process, or any aspect of the adjuster’s communication that you don't understand.

Choosing between a public adjuster vs insurance adjuster is a significant decision. For policyholders in Oregon, Washington, or anywhere else facing complex claims after fire, flood, storm, or vandalism, understanding the nuances of communication and advocacy is essential for a successful outcome. Whether you are a homeowner, a business owner, a municipality, or a non-profit organization, selecting the right representation can dramatically affect your final settlement and your peace of mind during a challenging time. If you feel overwhelmed or uncertain about navigating the claims process alone, a public adjuster can provide the dedicated advocacy and expert guidance you need to secure the full and fair settlement you deserve.

7. When to Choose Each Type of Adjuster: Public Adjuster vs. Insurance Adjuster

Navigating the aftermath of property damage can be overwhelming. One of the most crucial decisions you'll face is choosing the right type of adjuster to represent your interests in the insurance claim process. This choice—between a public adjuster and an insurance adjuster—can significantly impact your final settlement and the speed of your recovery. Understanding the roles of each, and the circumstances that warrant engaging one over the other, is essential to maximizing your insurance benefits. This section explores the critical factors influencing this decision, offering guidance tailored to residential homeowners, commercial property owners, municipalities, and anyone navigating the complexities of an insurance claim.

The fundamental difference lies in who each adjuster represents. An insurance adjuster works for the insurance company. Their job is to assess the damage, investigate the claim, and determine the amount the insurance company will pay. A public adjuster, on the other hand, works exclusively for you, the policyholder. They advocate for your best interests, ensuring you receive a fair and just settlement based on your policy coverage.

Deciding which type of adjuster is right for you depends on several interconnected factors:

-

Claim Complexity and Dollar Value: For simple claims with readily apparent damage and lower dollar amounts (e.g., a minor kitchen fire resulting in $15,000 in damage), an insurance adjuster may suffice. The process is often straightforward, and the insurance company is incentivized to resolve such claims quickly. However, for complex claims involving extensive damage, business interruption, disputed coverage, or high dollar values (e.g., hurricane damage with a $300,000 initial estimate), a public adjuster’s expertise becomes invaluable. They possess the knowledge and experience to navigate complex policy language, accurately assess all damages (including often overlooked items), and negotiate effectively with the insurance company to secure a higher settlement.

-

Insurance Company Cooperation Level: A cooperative and responsive insurance company can simplify the claims process, even for moderately complex situations. However, if the insurance company appears uncooperative, delays the process, disputes coverage, or offers a lowball settlement, engaging a public adjuster can level the playing field. For instance, if a hail damage claim is disputed by the insurance company, a public adjuster can provide expert assessments and negotiate forcefully on your behalf.

-

Policyholder Experience and Available Time: Do you have the time and expertise to thoroughly document the damage, understand your policy coverage, and negotiate with the insurance company? If not, a public adjuster can alleviate this burden. They handle all aspects of the claim, allowing you to focus on recovery. This is particularly helpful for commercial property owners dealing with business interruption claims, where accurate documentation and timely negotiation are critical for minimizing financial losses.

-

Policy Language Complexity: Insurance policies are notoriously complex. A public adjuster possesses in-depth knowledge of policy language and coverage nuances. They can decipher the fine print, identify applicable coverage, and ensure all eligible damages are included in your claim. This is especially valuable for commercial properties and businesses with specialized coverage needs.

Pros and Cons of Each Type of Adjuster:

-

Insurance Adjusters:

- Pros: Appropriate for straightforward, smaller claims; often efficient for undisputed losses.

- Cons: Potential for underpayment, particularly in complex situations; biased towards the insurance company’s interests.

-

Public Adjusters:

- Pros: Valuable for complex, high-value, or disputed claims; advocate solely for the policyholder; expertise in maximizing settlements.

- Cons: Incur a fee (typically a percentage of the settlement); may not be necessary for simple, straightforward claims.

Actionable Tips:

- Consider hiring a public adjuster for claims exceeding $50,000 or involving complex coverage issues.

- Evaluate the insurance company's initial response and cooperation level.

- Obtain multiple opinions, including from a public adjuster, for high-value claims before accepting a settlement.

- Assess your own expertise and available time for claim management.

- Thoroughly review your policy language and coverage details.

Choosing the right adjuster is a critical step in the recovery process. By carefully considering the complexity of your claim, the insurance company’s responsiveness, and your own resources, you can make an informed decision that maximizes your insurance recovery and minimizes your stress during a challenging time.

Public vs Insurance Adjuster: 7 Key Differences

| Aspect | Public Adjusters ⭐📊💡 | Insurance Adjusters ⭐📊💡 |

|---|---|---|

| Implementation Complexity 🔄 | Moderate to High – Detailed investigations and negotiations | Low to Moderate – Follow company procedures with faster claim processing |

| Resource Requirements ⚡ | Commission-based, no upfront cost, requires specialized expertise | Salaried or fee-based paid by insurer; access to internal systems |

| Expected Outcomes ⭐📊 | Typically higher settlements through advocacy and claim maximization | Faster settlements; may result in lower payouts due to insurer incentives |

| Ideal Use Cases 💡 | Complex, high-value, disputed, or specialized claims | Simple, straightforward claims with cooperative insurers |

| Key Advantages ⭐💡 | Dedicated policyholder representation, specialized loss expertise | Familiarity with insurer processes, quicker resolution, no additional cost |

Making the Right Choice for Your Claim

Choosing between a public adjuster vs insurance adjuster is a pivotal decision that significantly impacts your insurance claim outcome. This article has explored seven key differences between these two types of adjusters: who they represent, how they are paid, their areas of expertise, typical timelines, the legal framework they operate within, their communication styles, and finally, when it's most beneficial to engage each type. Understanding these nuances empowers you to navigate the often complex claims process with confidence and ensures you receive the maximum possible settlement for your property damage.

Mastering these concepts is invaluable, especially after experiencing a fire, flood, storm, or vandalism. Whether you're a residential homeowner in Oregon or Washington, a commercial property owner, a municipality, a non-profit organization, or simply feeling overwhelmed by the claims process, recognizing the distinct roles of public adjusters and insurance adjusters can be the difference between a fair settlement and an undervalued claim. Choosing the right representation can significantly alleviate the stress and burden of navigating the insurance claims process, allowing you to focus on recovery and rebuilding.

Deciding who will represent your interests is a crucial first step toward a successful claim. For personalized support and expert guidance in maximizing your claim outcome, consider NW Claims Management, Oregon and Washington's trusted public adjusting firm. We specialize in representing policyholders, ensuring they receive the full and fair settlement they deserve. Visit NW Claims Management today for a free claim evaluation and discover how we can help you secure the settlement you deserve.