Understanding Public Adjuster Cost: More Than Just Numbers

Imagine you're facing a complex insurance claim after a fire or flood. It's overwhelming, right? You're dealing with the emotional fallout, the logistics of repairs, and the intricacies of insurance policies. This is where a public adjuster comes in, acting as your expert negotiator in the confusing world of insurance. But how do they charge for their services?

Think of hiring a public adjuster like hiring a real estate agent. The agent only gets paid when they successfully sell your home. Similarly, public adjusters typically work on a contingency fee basis. They're invested in your success – they only get paid if you get paid.

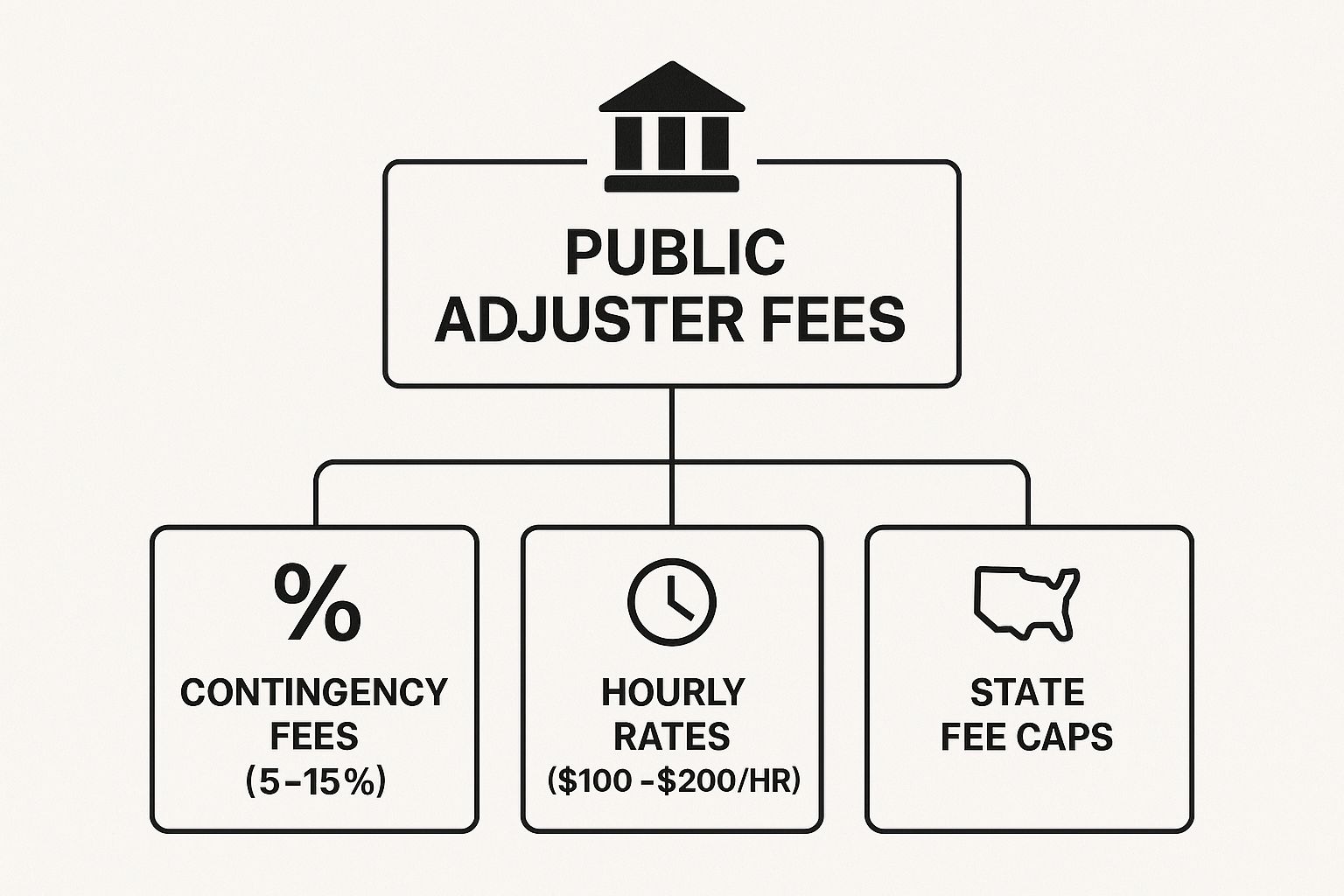

This infographic provides a visual breakdown of how public adjuster fees can be structured. It covers contingency fees, the less common hourly rates, and how state regulations can influence these fees. You'll notice that contingency fees, often between 5-15%, are the most common structure, offering a powerful incentive for adjusters to fight for the maximum settlement.

Breaking Down Contingency Fees

Contingency fees are the industry standard, making it easier for policyholders to access professional help. Imagine having to pay a lawyer hourly while navigating a complicated claim – the costs could quickly become prohibitive. With a contingency fee, the financial risk is significantly lower.

The following table outlines the different fee structures used by public adjusters.

Public Adjuster Fee Structures Comparison

| Fee Type | Typical Range | When You Pay | Pros | Cons |

|---|---|---|---|---|

| Contingency Fee | 5-15% of the settlement | Only after a successful claim | No upfront costs, adjuster incentivized to maximize settlement | You pay a percentage of your settlement |

| Hourly Rate | Varies | Paid regularly, regardless of claim outcome | More control over costs for smaller claims | Can become expensive for complex claims |

| Flat Fee | Varies | Paid upfront | Predictable cost | Less common, may not be suitable for all claim types |

As you can see, each fee structure has its advantages and disadvantages. The best choice for you will depend on the specifics of your situation.

What Happens If Your Claim Is Denied?

A key benefit of the contingency fee structure is that if your claim is denied, you don't owe the adjuster anything. It's a "no win, no fee" arrangement, minimizing your financial exposure during an already stressful time. This also underscores the importance of choosing a reputable public adjuster with a strong track record of success.

Contingency Fees in Action: A Real-World Example

Let's say your home suffers significant damage from a hurricane, and your insurance company offers a $50,000 settlement. You hire a public adjuster with a 10% contingency fee. If the adjuster successfully negotiates a $75,000 settlement, their fee would be $7,500, leaving you with $67,500 – a significant increase from the initial offer. Discover more insights on public adjuster rates.

The Value Beyond the Percentage

Understanding public adjuster cost isn't just about knowing the percentage; it's about recognizing the value they bring. They leverage their expertise to navigate the complex claims process, advocate for your best interests, and ultimately aim to maximize your settlement. This model has made public adjusters a valuable resource for policyholders who might otherwise be overwhelmed by the intricacies of insurance claims.

How Your State Shapes Public Adjuster Cost

Think of it like this: just as speed limits change when you cross from one state to the next, so too do the rules and regulations surrounding public adjuster fees. Some states have your back, putting a cap on how much adjusters can charge and making sure contracts are crystal clear. Other states operate more on a "buyer beware" system, leaving pricing largely up to market forces. Knowing where your state falls on this spectrum is the first step in navigating the sometimes-choppy waters of public adjuster costs.

Let's take a look at some real-world examples. States like Florida and Texas, often in the path of hurricanes, have strong consumer protection laws in place. These regulations often include caps on contingency fees, particularly during declared emergencies, preventing price gouging when people are most vulnerable. They also usually require adjusters to provide detailed contracts, spelling out all fees and expenses.

On the other hand, some states have a lighter touch when it comes to regulation. This can lead to a much wider range of fees, making comparison shopping essential. In these less-regulated environments, carefully vetting potential adjusters and negotiating terms becomes even more important.

This screenshot from the National Association of Public Insurance Adjusters (NAPIA) website paints a clear picture of this regulatory patchwork across the US. The map uses color-coding to show the varying levels of regulation, highlighting the need to understand the specific rules in your area. You’ll notice some states are marked as having "Emergency Fee Adjustments," illustrating how rules can shift during large-scale disasters. If you’re in Oregon dealing with property damage, for instance, you'd want to explore resources tailored to your state’s specific regulations, like Oregon Residential Public Adjuster Services.

Often, these state-specific regulations are a direct result of past experiences with major disasters. After Hurricane Andrew ravaged Florida in 1992, the state implemented stricter regulations on public adjusters to protect consumers from unfair practices. This serves as a powerful lesson for other states facing similar challenges. Understanding the history behind these rules can give you a deeper appreciation for their purpose and help you use them to your advantage. Knowing the rules of the game allows you to manage your expectations and make sure you’re getting a fair shake.

What Really Drives Your Public Adjuster Cost

Beyond the basic percentage, a lot goes into determining your final public adjuster cost and the value you get. Think of it like dining out. Two restaurants might offer seemingly identical dishes, but the price varies. Location, ambiance, ingredients, and the chef’s experience all play a role. Similarly, a water damage claim in your basement is a different beast than fire damage to your roof, affecting the public adjuster’s fees.

Claim Complexity and Cost

Claim complexity significantly impacts cost. A simple claim with clear damages and easy-to-access documents might mean a lower fee. But things like extensive structural damage, complex policy wording, or coverage disputes require more expertise and time—and therefore, a higher fee. Imagine a collapsed roof after a hurricane versus a broken window from a small storm. The hurricane claim is far more complex, requiring more from your adjuster. They consider this estimated time and resource investment when setting their fee.

Commercial Vs. Residential: A Tale of Two Claims

Public adjusters often use different rates for commercial and residential properties. Commercial claims usually involve larger sums, more complicated insurance policies, and potential business interruption losses, requiring specialized knowledge. This is like seeing a specialist versus a general practitioner. The specialist’s expertise commands a higher price.

The Adjuster's Track Record and Your Insurance Company

The adjuster’s experience and their history with your specific insurance company matters. An adjuster familiar with your insurer’s procedures can often negotiate more efficiently, leading to a faster resolution and a better settlement. Think of it as having an "insider" working for you. This expertise could justify a higher upfront fee. Public adjuster income also varies by experience and location. They earn roughly $79,211 annually, within a range of $61,000 to $104,000. Experienced adjusters handling complex commercial claims can earn significantly more than those managing smaller residential cases. Discover more insights into public adjuster income.

Market Conditions and Their Influence

Finally, market conditions, especially after large-scale disasters, can impact costs. Increased demand post-hurricane or wildfire can lead to higher fees simply because there are more claims than adjusters available. Understanding all these factors helps you negotiate a fair price and maximize the value of your public adjuster.

When Public Adjuster Cost Actually Pays Off

Sometimes, spending money to make money is a brilliant strategy. Other times, it's throwing good money after bad. When it comes to hiring a public adjuster, knowing the difference before you sign on the dotted line is essential. So let's explore when the cost of a public adjuster truly delivers a return on your investment.

From $15,000 to $45,000: Real-World Examples

We'll dive into real stories from homeowners who've been there. We'll see how a public adjuster might transform a $15,000 insurance settlement offer into a $45,000 payout, and we'll also examine cases where the adjuster's fee barely justified a small increase. These examples will help illustrate the "tipping point"—the point where professional help becomes financially worthwhile. It’s interesting to note that the global claims adjusting industry, including public adjusters, was valued at approximately $43.7 billion in 2024 and has seen 9.6% annual growth over the past three years. In the U.S. alone, the industry reached $14.6 billion in 2024, showcasing the increasing need for these services. Learn more about industry growth here. This growth reflects a growing understanding of the value a public adjuster can bring.

Beyond Claim Size: Factors That Matter

The size of your claim isn’t the only piece of the puzzle. Your insurance company’s reputation plays a role, too. Some insurers are known for their fair dealings, while others have a reputation for offering lowball settlements. A public adjuster's experience navigating these nuances can significantly influence your final payout.

Navigating Different Claim Scenarios

Let's walk through a few common scenarios. For a simple claim, you likely don't need a public adjuster. But for a complex claim, professional assistance can pay dividends. And for a denied claim? A public adjuster could be your only hope. This framework will help you see more clearly when a public adjuster's cost is a wise investment.

The Math Behind Profitability: Breakpoints and ROI

We'll also break down the mathematical breakpoints—the numbers that determine whether hiring a public adjuster is actually profitable. Understanding these calculations puts you in the driver's seat. Remember, it's not just about the percentage fee; it’s about your net benefit after the adjuster takes their share. Let’s look at some examples.

To illustrate when using a public adjuster might make financial sense, let’s consider the following table. It outlines some hypothetical claim scenarios and the potential return on investment (ROI) after factoring in a typical public adjuster fee.

| Claim Size Range | Typical Fee | Average Settlement Increase | Net Benefit | ROI Percentage |

|---|---|---|---|---|

| $10,000 – $20,000 | 10% | $5,000 | $4,000 | 40% |

| $20,000 – $50,000 | 10% | $10,000 | $8,000 | 40% |

| $50,000 – $100,000 | 10% | $25,000 | $20,000 | 40% |

| $100,000+ | 10% | $50,000 | $40,000 | 40% |

As you can see, even after accounting for the adjuster's fee, there's a substantial potential net benefit across various claim sizes. This underscores how a public adjuster can significantly improve your financial outcome. Of course, these are just examples, and the actual results will vary based on the specifics of your situation.

By the end of this section, you’ll have a clear understanding of how to decide if hiring a public adjuster is the right financial move for you. It’s all about making smart choices based on your individual circumstances.

Hidden Costs That Can Surprise You

When you’re dealing with the aftermath of property damage, figuring out public adjuster fees can be tricky. That advertised percentage they quote? Think of it like the sticker price on a new car – rarely the whole story. Savvy property owners need to understand the total potential cost before signing on the dotted line. Some adjusters are upfront, while others might slip in extra charges for things like specialized inspections, expert witness testimony, or mountains of paperwork.

Decoding Legitimate Vs. Red Flag Costs

So, how can you tell the difference between a justified extra cost and a hidden fee designed to boost the adjuster’s bottom line? Think of it this way: if your house suffered a major structural collapse, bringing in a structural engineer makes perfect sense and adds a legitimate cost. However, getting charged an arm and a leg for routine paperwork? Red flag. That's where carefully reviewing your contract comes in.

Contract Clarity: Your Shield Against Surprise Bills

Reading the fine print of your contract is absolutely essential. Look for clauses that detail every possible expense. Don't be shy! Ask questions upfront. This proactive approach can prevent painful surprises down the road. And remember, you're not stuck with what they initially offer. Feel free to negotiate a fee structure that works for you and reflects the complexity of your specific claim. If you're dealing with a commercial property, the intricacies of claims management and costs can be even more complex. You might find this resource on Commercial Claims Management helpful.

Real Contract Examples: Protecting Your Wallet

Let's paint a picture with some real-world examples. A well-written contract will clearly lay out the contingency fee percentage, explain exactly which expenses are covered within that percentage, and detail the process for approving any additional costs. A vague contract, however, might as well have a giant question mark where the final cost should be. This is where an experienced public adjuster can truly shine, helping you navigate the complexities and avoid potentially inflated fees.

Transparency Vs. Hidden Fees: Spotting the Difference

The golden rule? Transparency. Choose an adjuster who's an open book about potential costs, not one who hides fees in the fine print. A good adjuster understands their success is tied to yours. Their focus should be on maximizing your insurance payout, not padding their own profits. This shared goal is a crucial element when selecting the right adjuster. By understanding the potential hidden costs associated with public adjuster services, you can make informed decisions and protect your finances during an already stressful time. This knowledge empowers you to negotiate effectively and secure the best possible outcome for your claim.

Getting Maximum Value From Your Public Adjuster Investment

Smart property owners know that hiring a public adjuster isn't just about minimizing costs. It's about maximizing the value you receive for your investment. Think of it like hiring a contractor: the cheapest bid isn't always the best. You need someone experienced and reputable who will get the job done right. This section will guide you on actively participating in the claims process, working with your adjuster for the best possible outcome.

Communication Is Key: Speeding Up Your Claim

Keeping the lines of communication open with your adjuster is essential. Regular updates on new developments, prompt responses to their requests, and asking clarifying questions can significantly speed up the process. Imagine your adjuster is piecing together a puzzle: they need all the information to build a strong case.

Organized Documentation: Efficiency Equals Savings

Just like a well-organized toolbox makes a repair job smoother, organized documentation makes your adjuster's job easier and could even save you money. Gathering policy documents, receipts, photos, and repair estimates in a clear format allows your adjuster to focus on negotiating your claim, not chasing paperwork. If you need help with organization, you might consider Claims Management Services.

Your Actions, Your Timeline, Your Settlement

Your actions directly impact the timeline and your final settlement. Responding promptly, attending inspections, and active participation shows the insurance company you’re serious about your claim, preventing delays and demonstrating your commitment to a fair resolution. This proactive approach can significantly influence the outcome.

Setting Clear Expectations: Avoiding Costly Misunderstandings

From the start, set clear expectations. Discuss communication frequency and establish a process for reviewing progress. Think of it as a roadmap for your claim, helping you avoid costly detours caused by miscommunication or unmet expectations.

Tracking Progress: Ensuring Premium Service

Regularly check in with your adjuster, review updates, and ask questions about their strategy. This ensures you’re receiving the service you’re paying for. By actively tracking progress, you become an informed partner invested in the outcome, not just a passive recipient of services. Working effectively with your public adjuster helps you maximize your investment and achieve the best possible result. Studies have shown that settlements can be 2-3 times higher with a public adjuster, even after their fees. The contingency fee structure, where the adjuster is paid a percentage of the settlement, makes this financially viable for policyholders. Learn more about public adjuster rates here.

Making Smart Public Adjuster Cost Decisions

So, you've got a better grasp on how public adjusters charge. Now, let's talk about putting that knowledge to work and making smart decisions that benefit both your property and your finances. Think of this section as your practical toolkit, filled with strategies you can use right away to evaluate adjusters, negotiate fees, and build a productive working relationship.

Evaluating Potential Adjusters: Beyond the Price Tag

Choosing a public adjuster is a lot like choosing a surgeon – you wouldn't just pick the cheapest option, would you? Experience, reputation, and a solid track record are critical. Think of it this way: you're entrusting them with a significant financial matter, just as you'd entrust a surgeon with your health. So, ask the tough questions:

- What kind of experience do they have with claims similar to yours (e.g., fire damage, water damage)? Have they handled cases in your specific geographic area?

- Can they provide references from past clients? Talking to someone who's been in your shoes can offer invaluable insights.

- What's their communication style? Do they keep clients informed? How do they approach negotiation with insurance companies?

These questions help you assess not just their skills, but also whether their personality and approach are a good fit for you. A slightly higher fee might be worth it for an adjuster with a proven track record of maximizing settlements.

Negotiating Fair Fees: Your Claim, Your Terms

Remember, the initial fee an adjuster proposes is just a starting point. Negotiation is perfectly acceptable, especially for complex claims. It's like buying a car – you wouldn't just accept the sticker price without trying to haggle a bit. Consider these factors during the negotiation process:

- Claim Complexity: Is it a relatively straightforward claim, or does it involve multiple parties and intricate details? Think of it like baking a cake versus building a house – the latter requires more expertise and effort, thus justifying a higher cost.

- State Regulations: Your state may have regulations regarding public adjuster fees, such as caps on percentage-based fees. It's essential to be aware of these rules.

- Potential Settlement: What's a realistic estimate of your potential payout? This helps you understand the adjuster’s fee in context. If the potential settlement is substantial, a higher percentage fee might still result in a larger net gain for you.

Understanding these elements empowers you to negotiate a fee that aligns with your unique circumstances.

Building Strong Working Relationships: Collaboration for Success

Your relationship with your public adjuster should be a partnership. It's a collaborative effort, like a coach and athlete working together to achieve a goal. Effective communication is key to maximizing your claim's potential. Here's how to foster that collaboration:

- Clear Communication: Establish expectations for communication early on. Regular updates and prompt responses to your inquiries are crucial.

- Organized Documentation: Provide all necessary documentation in a clear, organized manner. This streamlines the claims process and allows the adjuster to focus on negotiating, not chasing paperwork. Imagine it like providing a chef with all the ingredients they need – it makes the cooking process much smoother.

- Active Participation: Stay involved throughout the claims process. Attend inspections, ask questions, and provide any requested information promptly. This shows the adjuster that you're invested in the outcome.

By working closely with your adjuster, you create a strong foundation for a successful and efficient claim resolution.

Ready to take the reins and ensure you receive the maximum possible settlement? Contact NW Claims Management today for a free claim evaluation. Our expert public adjusters are ready to guide you through the process and advocate for your rights. Get Your Free Claim Evaluation Now!