Reading Your Policy Like Your Money Depends on It

Let's be honest, most of us only really dive into our insurance policies after something bad has happened. I've talked to so many homeowners who were blindsided by what their insurance didn't cover. Let's make sure that doesn't happen to you. We're going to break down that confusing insurance lingo, look at real examples where people lost serious money because of coverage gaps, and pinpoint the specific policy details that can make or break your claim.

One of the biggest traps is thinking all insurance policies are the same. They absolutely are not. Your neighbor might have "comprehensive coverage" that looks just like yours on paper but is actually totally different, even if you both bought it from the same company. This is why understanding your declarations page, coverage limits, and exclusions is so important. Your declarations page is like a snapshot of your coverage, showing the maximum amounts the insurance company will pay for different types of damage. Don't just skim it – really study it. Knowing you have $250,000 in dwelling coverage is meaningless if it doesn't include the type of damage you've experienced.

For example, I once helped a homeowner whose detached garage was crushed by a falling tree. He was certain his homeowner's insurance would cover it. Turns out, his policy specifically excluded detached structures damaged by falling objects unless the main house was also damaged. That little detail cost him $20,000.

This screenshot from the Insurance Information Institute illustrates some key statistics on homeowners insurance:

As you can see, understanding your policy is essential, especially with the rising costs of claims. Speaking of which, the average claim payout (for both property damage and liability) between 2018 and 2022 was $15,749, according to the Insurance Information Institute (Triple-I). You can find more info on claim payouts at Insurify. This just highlights how important it is to get the most out of your legitimate claim. Don't wait until it's too late. Review your policy now, ask your agent any questions you have, and make sure you're actually protected before you need to file a claim. Knowing what your policy really covers is the first step to a fair settlement.

Coverage Types and What They Actually Mean

Before we go any further, let's clarify some common insurance terms. The table below breaks down different coverage types and how they might affect your claim.

| Coverage Type | What It Covers | Common Limitations | Claim Impact |

|---|---|---|---|

| Dwelling Coverage | Damage to the structure of your home | Excludes things like floods, earthquakes (often require separate policies), and wear and tear. Payout may be limited by your coverage amount. | Covers the cost to repair or rebuild your house up to your coverage limit. |

| Other Structures Coverage | Detached structures like garages, sheds, fences | Often a percentage of your dwelling coverage. May have specific exclusions. | Covers damage to these structures, but check your limits and exclusions. |

| Personal Property Coverage | Your belongings inside the house | Usually covers theft, fire, and other listed perils. Often has limits for specific items like jewelry or electronics. | Pays to repair or replace your belongings, up to your coverage limits and considering depreciation. |

| Loss of Use Coverage | Additional living expenses if your home is uninhabitable | Limited to a specific time period and amount. | Covers hotel bills, temporary housing, and other expenses while your home is being repaired. |

| Liability Coverage | If someone is injured on your property and you're found liable | Has a coverage limit. | Pays for medical expenses and legal fees. |

This table provides a general overview. Your specific policy will have its own details and limitations. Reviewing it carefully with your agent is crucial for understanding your coverage.

Understanding these terms and how they interact in your policy is crucial. Don't hesitate to reach out to your insurance agent for clarification. They can help you navigate the specifics of your coverage and address any concerns.

Documenting Damage Like Your Settlement Depends on It

Your property damage claim hinges on the strength of your documentation. I've seen firsthand, working with public adjusters, how solid evidence can be the deciding factor between a smooth settlement and a protracted fight. It's not a matter of getting lucky; it's about understanding what insurance companies are looking for.

Photographing for Success

Think of your photos as a visual narrative. Begin with wide shots to establish the overall scene, then zoom in for close-ups of the specifics. Let's say a tree landed on your roof. Your first photo should show the entire tree on the roof from a distance. Next, get closer, focusing on where branches pierced the shingles. Finally, capture detailed shots of the interior damage, such as water stains on the ceiling. This comprehensive approach gives adjusters a complete understanding of the situation. Aim for 20-30 photos per damaged item, making sure to capture every angle.

This means looking beyond the obvious. Photograph seemingly minor cracks in the walls, warped flooring, even damage to your landscaping. These details add up and contribute to a more comprehensive claim. Remember, you're documenting the full scope of the damage, not just the most dramatic aspects.

Organizing Your Evidence

A jumble of photos won't be effective. Use apps specifically designed for property documentation. For example, take a look at this screenshot from Magicplan, an app that helps create floor plans and organize your photos:

Magicplan lets you build a visual record of your property, linking photos directly to specific locations and items within the floor plan. This organized approach strengthens your claim by making it easy for the adjuster to grasp the extent of the damage.

In addition to photos, maintain a detailed inventory of all damaged items. Include descriptions, purchase dates, estimated values, and receipts whenever possible. A spreadsheet or a dedicated inventory app can be incredibly helpful. This helps avoid disagreements down the line about what was damaged and how much it was worth. For additional resources and helpful articles, you might find the NW Claims Management Blog useful.

Crafting a Compelling Narrative

Your documentation shouldn't just show the damage; it should tell the story of how the incident affected you. This adds a human dimension to your claim, making it more relatable to the adjuster. Explain how the damage has disrupted your life, highlighting any resulting hardship or inconvenience.

However, it’s important to keep your narrative factual and focused on the damage itself. Avoid emotional pleas or inflated claims. Your objective is to present a clear, concise, and compelling case for a fair settlement. By combining detailed photographs, organized inventories, and a factual narrative, you build a strong case that supports your claim and improves your chances of receiving the compensation you deserve.

Understanding What Really Happens After You File

Filing a property damage claim can feel like shouting into the void. You've carefully documented everything, filled out the forms, and…nothing. So, what’s actually happening on the other end? The truth is, the claims process has changed a lot, and outdated expectations can lead to major headaches. Let me give you a peek behind the curtain.

One of the biggest factors is how adjusters prioritize their workload. After a major storm, for example, they’re absolutely buried. Claims with serious damage and displaced families understandably jump to the top of the pile, while smaller, less urgent claims might have to wait. This is where communicating clearly and concisely is key. A short, professional email with a well-organized summary and a few key photos attached is much more effective than a rambling voicemail.

Technology is also changing the game. Many insurance companies now use AI-powered software like CCC Intelligent Solutions to assess damage from photos, generate quick initial estimates, and even predict future claims. This can speed things up for simple claims, but it also means your documentation needs to be crystal clear and leave nothing out.

Timing matters too. After a big storm, it can take weeks for an adjuster to even get to your property. And with climate-related events happening more often, the backlog just keeps growing. These events have gone from impacting 15% of property and casualty claims in 2019 to a whopping 25% in 2023. The average wait for a final payment in the U.S. is now 44 days. Think about that. You can find more about this on property and casualty insurance statistics. This is why filing your claim quickly and following up strategically is so important.

Navigating the Claims Process

Take a look at this screenshot from the National Association of Insurance Commissioners (NAIC). It shows consumer complaint ratios for different insurance companies.

These ratios can tell you a lot about how different insurers handle claims. A higher complaint ratio could be a red flag, suggesting potential difficulties during the process. If you want to see how we handle these kinds of situations, check out our services page.

Understanding how adjusters think, using technology to your advantage, and knowing how timing impacts your claim can dramatically improve your experience. It’s not about gaming the system; it’s about working with it to get what you’re entitled to.

Building Real Relationships With Your Adjuster

Your relationship with your insurance adjuster can make a huge difference in how your property damage claim turns out. So many people go into this process ready for a fight, which just creates tension and can actually lead to a lower settlement. I’ve talked to adjusters and homeowners alike, and I’ve got a good idea of what really builds a productive relationship. This isn't about tricks; it's about understanding the system and working smart.

Understanding the Adjuster's Perspective

Adjusters are often swamped, especially after a major storm or widespread event. They might be juggling hundreds of claims at once, each with its own set of details and complications. Just imagine that workload! Showing a little empathy and understanding can go a long way. This doesn’t mean rolling over; it means being professional and presenting your case clearly and effectively.

This screenshot from Wikipedia highlights the adjuster's role as an investigator. They're figuring out how bad the damage is and how much the insurance company should pay. Knowing they're in investigation mode helps you prepare the right documentation.

Preparing for a Productive Meeting

Before you meet with the adjuster, get all your ducks in a row. Organize your documents, photos, and any inventory lists you have. This shows you're organized and respectful of their time. Have a copy of your insurance policy handy and be prepared to talk about your specific coverage. This proves you've done your homework. Services like NW Claims Management can also be a great resource to help you get ready for these meetings.

It's also helpful to put together a quick summary of the damage, hitting the key points. This helps the adjuster get up to speed quickly and understand the overall scope of your claim. Think of it like a well-organized presentation, not just a laundry list of complaints.

To help you further, here’s a checklist I’ve put together over the years. It covers everything you should have ready before meeting with your adjuster. Trust me, this will make the process so much smoother.

Adjuster Meeting Preparation Checklist

Essential items and information to have ready when meeting with your insurance adjuster

| Category | Required Items | Why It Matters | Pro Tips |

|---|---|---|---|

| Documentation | Photos, videos, inventory lists, receipts, insurance policy, repair estimates | Provides evidence of damage and value of lost/damaged items. Demonstrates preparedness. | Organize chronologically and by room/area. Keep digital and physical copies. |

| Property Information | Address, age of property, previous repairs/renovations | Helps adjuster understand the context of the damage and assess value. | Have any relevant permits or documentation readily available. |

| Damage Details | Detailed description of the event and resulting damage, dates of occurrence | Provides a clear understanding of the incident and impact. | Be specific and factual. Avoid emotional language. |

| Personal Information | Contact information, insurance policy number | Ensures smooth communication and proper identification of your claim. | Have a dedicated email address for claim correspondence. |

| Questions & Concerns | List of questions for the adjuster, any concerns about the process | Allows for open communication and clarification. Demonstrates proactive engagement. | Prioritize your questions and be prepared to take notes. |

This checklist ensures you’re prepared for any questions the adjuster may have and allows you to present your case effectively. Having all this organized ahead of time will not only save you time but also help project confidence and competence, leading to a smoother claims process.

Effective Communication Strategies

When you're talking to your adjuster, stick to the facts, not the feelings. It's perfectly normal to be frustrated, but staying professional helps build trust. Ask questions about the process and your coverage. This shows you’re involved and want a fair outcome.

For example, instead of saying, “My roof is ruined!” Try, “The hail caused significant damage to the shingles, as you can see in these photos. Can you explain how the depreciation will be calculated in the repair estimate?” This approach gets you the information you need and keeps things moving forward. Focus on asking open-ended questions that encourage the adjuster to give detailed answers. This helps you understand their perspective and spot any potential issues early on. Remember, you and the adjuster are working towards a resolution, not against each other.

Deciding When Professional Help Makes Financial Sense

So, you’ve started the property damage claim process. You’ve documented everything, notified your insurer, and now… you’re staring down a mountain of paperwork and the daunting prospect of negotiations. It’s perfectly normal to wonder, “Do I really need a public adjuster?” Honestly, the answer depends on your situation and how complex your claim is. I’ve spoken with a lot of public adjusters and homeowners over the years, and that’s the key takeaway.

Let’s be real about the value a public adjuster brings. They’re pros at navigating the tangled web of insurance policies – something most of us aren’t. They know what documentation matters, how to negotiate effectively with insurance companies, and how to get you the best possible settlement. Think of them as your experienced sherpa guiding you through the Himalayas of insurance claims. They know the terrain, the language, and the best routes.

Evaluating Your Needs

When does hiring a professional truly make financial sense? Here are a few scenarios I’ve seen where it can be a game-changer:

- Extensive Damage: If your property suffered significant damage, a public adjuster is invaluable. They'll accurately assess the full extent, including hidden damage that you might miss. I remember one case where a homeowner thought the damage was limited to a few rooms, but the adjuster uncovered structural issues that significantly increased the claim.

- Complex Policy Language: Let’s face it, insurance policies are written in a language all their own. A public adjuster deciphers the fine print and makes sure you get everything you’re entitled to. I once had a client whose policy included a clause for additional living expenses, something they would have completely overlooked without their adjuster.

- Disputed Claims: If your claim is denied or the settlement offer is too low, a public adjuster is your advocate. They’re seasoned negotiators and know how to handle insurance company tactics. I’ve seen adjusters turn denied claims into substantial settlements.

For more information, you might find NW Claims Management's page on Oregon Residential Public Adjusters helpful.

Understanding Fee Structures

Public adjusters usually work on contingency. They take a percentage of your final settlement, typically between 5% and 15%. It varies based on the complexity of the claim and your state. While that might seem like a lot, a good adjuster can often secure a much larger settlement than you could on your own, making their fee worthwhile.

This screenshot from the National Association of Public Insurance Adjusters (NAPIA) shows their "Find an Adjuster" tool:

NAPIA is a great resource for finding qualified public adjusters in your area, ensuring you work with a reputable professional familiar with your state's laws.

Making an Informed Decision

Hiring a public adjuster is a personal decision. Weigh the complexity of your claim, how comfortable you are handling the process yourself, and the potential financial upside. Even if you handle the initial steps, you can always bring in a public adjuster later if things get tricky or the offer seems unfair. It's about having options and making the smartest financial choice for your needs.

Sidestepping the Mistakes That Kill Claims

This screenshot from Consumer Reports offers some solid advice on filing homeowners insurance claims. It really highlights how important thorough documentation and quick communication are. Think detailed records, photos, and videos – anything that backs up your claim. These are absolutely crucial for a successful property damage claim.

One of the biggest mistakes I see is people dragging their feet on filing. You might think you have time, but deadlines can sneak up on you. Some policies have really short reporting windows, like 24-48 hours. Miss that, and you could seriously jeopardize your chances of getting paid. Plus, the longer you wait, the harder it is to gather evidence. Memories get fuzzy, the damage can get worse, and it’s just tougher to piece together what happened.

For example, I had a client who waited months to report a leaky roof. They figured it was minor. By the time they filed, the mold and water damage were extensive. The insurance company argued it was a pre-existing issue and not covered. If they’d acted quickly, they might have avoided a huge repair bill.

Another common trap is poor communication. Don't just leave a voicemail and think you’re good. Follow up with emails, keep a record of all your conversations, and make absolutely sure everything is documented. Think of it like building a case file – every single interaction counts. If your property damage is commercial, you might want to check out more on commercial claims and how we can help you at NW Claims Management.

Finally, don’t underestimate the importance of being organized. So many claims get delayed because the documentation is a mess. Use a spreadsheet, a dedicated app like ClaimTrack, or even just a well-organized folder. Trust me, this makes your adjuster’s life easier and shows you’re serious about the process. Being organized builds credibility with the insurance company and protects you if there are any disputes later on. You'll have a clear record of everything related to your claim.

Your Practical Roadmap to Claim Success

Success with property damage claims boils down to three things: preparation, documentation, and good old-fashioned communication. This section puts it all together into a practical framework you can use, no matter your situation. Think of it as your trusty guide, complete with realistic timelines, communication tips, and benchmarks to check if your claim is on track or needs a little nudge.

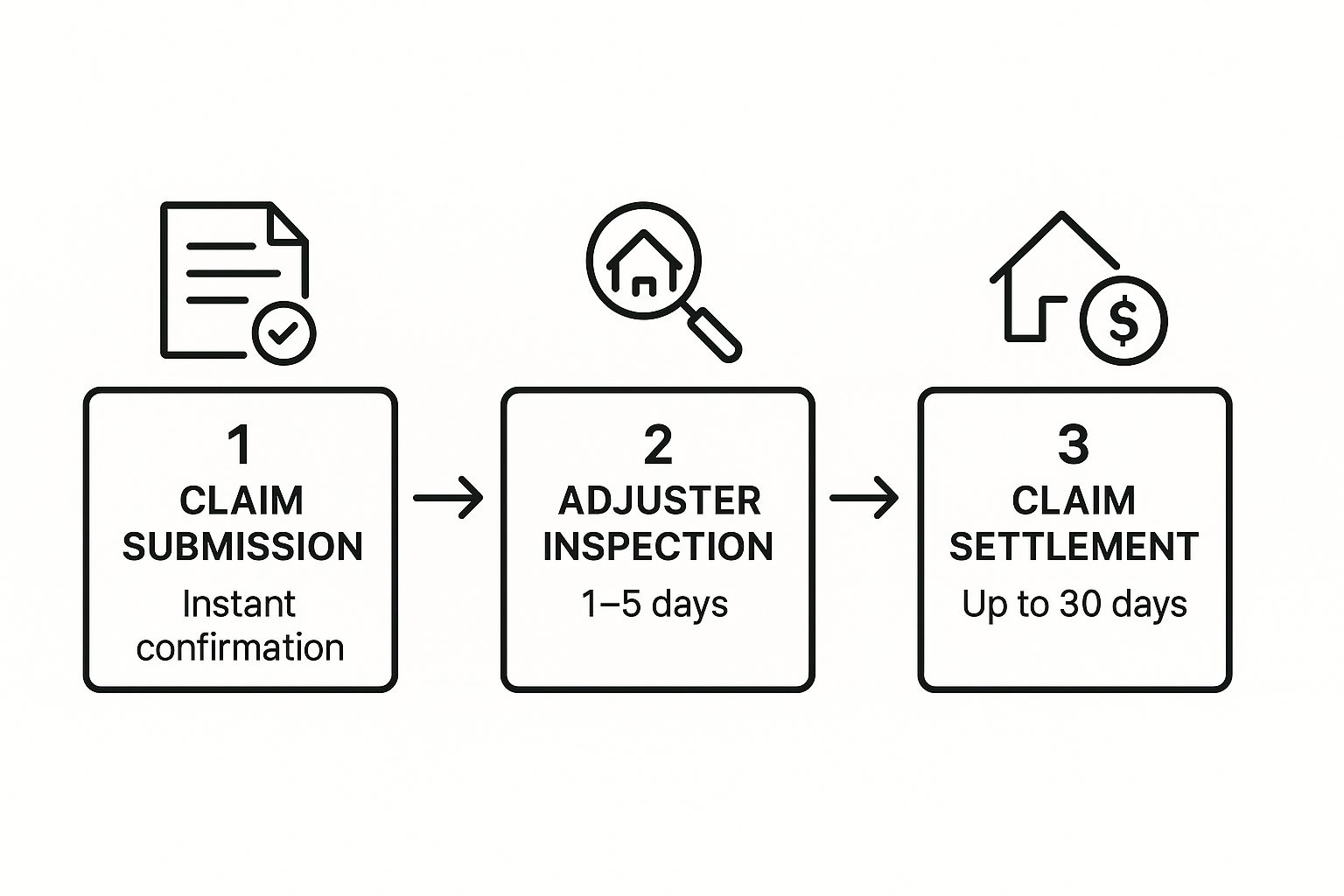

This infographic gives you a visual of the typical claim process, from the initial submission all the way to the final settlement. You should get confirmation the second you submit. An adjuster usually takes a look at the damage within 1–5 days, and you could see a settlement in about 30 days. But keep in mind, these are just averages. More complicated claims or a sudden surge in claims (like after a big storm) can really stretch these timelines out.

Immediate Actions After Damage Occurs

Right after the damage happens, here's what you need to do:

-

Ensure Safety: Before anything else, make sure everyone is safe. Take care of any immediate dangers first.

-

Document Everything: Photos, videos – document all the damage. Remember all that detailed documentation we talked about? This is where it pays off.

-

Contact Your Insurer: Get in touch with your insurance company ASAP to get the ball rolling. Don't delay.

-

Make Temporary Repairs: Stop any further damage with temporary fixes, but keep every single receipt and take pictures of these repairs. This shows you’re taking action and preventing more loss.

Staying Organized Throughout the Process

Property damage claims can sometimes feel like a marathon, not a sprint, so staying organized is key:

-

Create a Centralized System: A physical folder, a digital folder, or even a dedicated app—find a system to keep all your claim-related stuff together. Think photos, videos, emails, repair estimates, basically anything related to your claim.

-

Maintain a Communication Log: Keep a running record of every conversation with your insurer. Jot down dates, times, names, and a quick summary of what you talked about. Trust me, this is gold if any disagreements pop up later.

-

Track Deadlines: Know the deadlines in your policy and put reminders in your calendar. Missing a deadline can seriously mess things up.

Recognizing When to Escalate

Sometimes, even when you do everything right, your claim might hit a snag. Here's when you should think about escalating:

-

Unresponsive Insurer: If your insurer is MIA or slow to respond, don’t be shy about following up. Being polite but persistent often works wonders.

-

Low Settlement Offer: If the settlement offer seems off, don’t just take it. Go back over your documentation, maybe talk to a professional, and negotiate for what’s fair.

-

Denied Claim: A denied claim isn’t the end of the world. Figure out why it was denied and explore your options. You might be able to appeal or get some legal advice.

A successful claim takes being proactive, organized, and informed. By following this roadmap and staying involved throughout, you'll have a much better shot at a fair and quick settlement. For expert help navigating your property damage claim, contact NW Claims Management at https://nwclaimsmanagement.com. We're here to help you get the settlement you deserve.