Understanding What Public Adjusters Really Do

A public adjuster is a licensed professional who works solely for the policyholder—you—during an insurance claim. This is a key difference between them and the insurance company's adjusters, who work for the insurer's best interests. Public adjusters ensure you receive a fair settlement, navigating the complex world of insurance policies to get you every penny you deserve. They provide expertise and support to property owners dealing with the aftermath of damage.

How Public Adjusters Differ From Other Adjusters

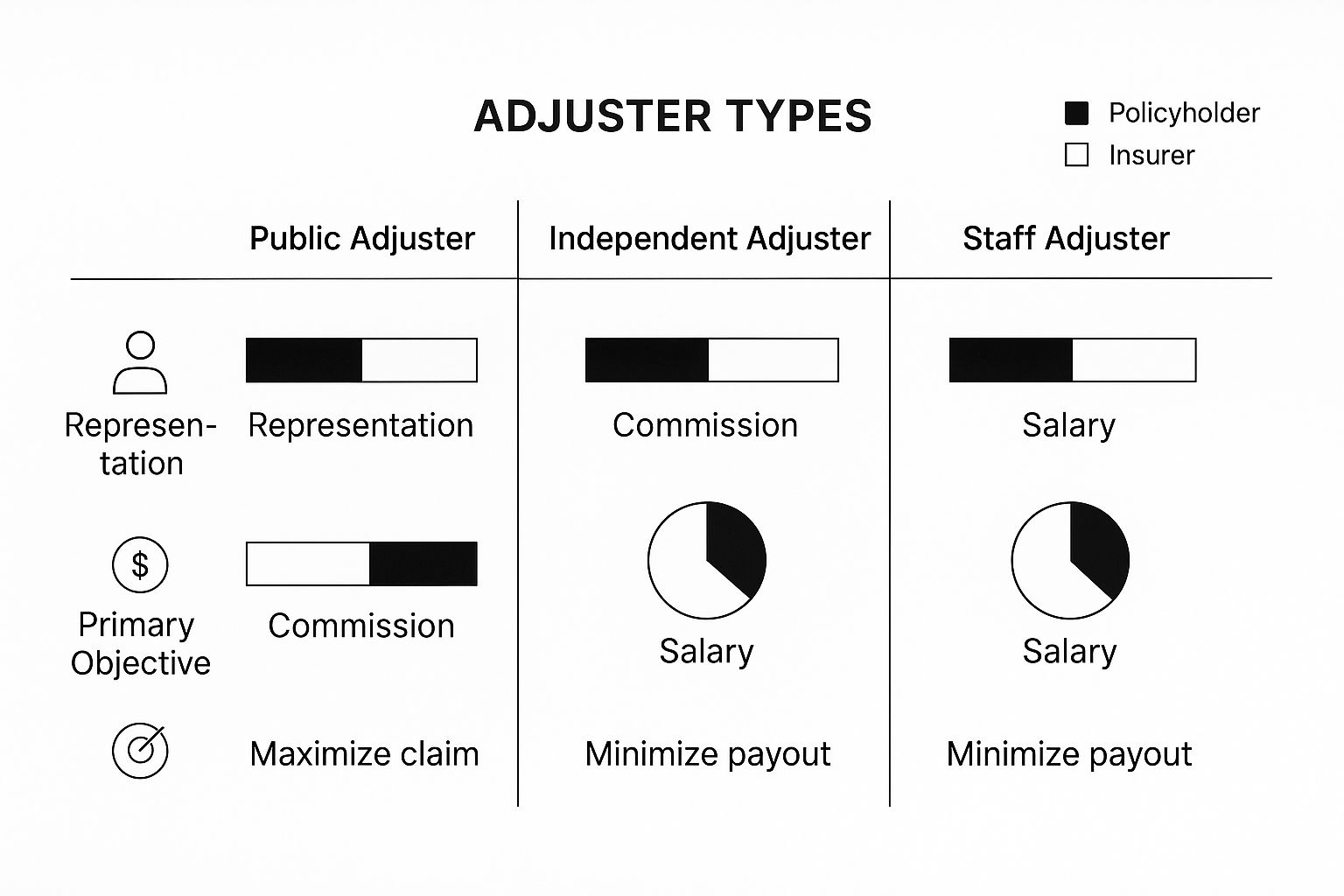

Different types of adjusters are involved in insurance claims, each with varying loyalties. This often creates confusion. Understanding the difference between adjusters helps you make informed decisions about your claim.

To illustrate these differences clearly, let's look at the roles of the different types of adjusters. The following infographic breaks down the roles of a Public Adjuster, an Independent Adjuster, and a Staff Adjuster:

Public adjusters work for the policyholder, receiving payment as a percentage of the final settlement, with the goal of maximizing your claim payout. Independent and staff adjusters, on the other hand, work directly for the insurance company. Their objective is often to minimize the payout amount. This difference in representation highlights the importance of having someone on your side when dealing with insurance companies. You might find this resource helpful: How to master the insurance claims process in Oregon.

To further clarify these differences, here's a table summarizing key aspects of each adjuster type:

Types of Insurance Adjusters Comparison

Clear breakdown showing who each adjuster type represents, how they're paid, and their primary objectives in your claim

| Adjuster Type | Who They Represent | Payment Method | Primary Goal |

|---|---|---|---|

| Public Adjuster | Policyholder | Percentage of the settlement | Maximize claim payout |

| Independent Adjuster | Insurance Company | Hourly rate from the insurance company | Minimize claim payout |

| Staff Adjuster | Insurance Company | Salary from the insurance company | Minimize claim payout |

As this table shows, having a public adjuster means having someone dedicated to achieving the highest possible settlement for you.

The Value a Public Adjuster Brings

Imagine your property is severely damaged by a fire. You're dealing with emotional stress and the complicated task of navigating your insurance policy and documenting the damage. A public adjuster's expertise helps handle the time-consuming paperwork, assess the damage, negotiate with the insurance company, and ensure you receive all coverage you’re entitled to. This frees you to focus on recovering and rebuilding.

Public adjusters often uncover coverage you might not know about. They can accurately assess and document all damages, including hidden or future costs, for a more comprehensive settlement. Their experience with insurance companies helps your claim to be handled efficiently, minimizing stress and maximizing your recovery. For example, a public adjuster might find covered code upgrades required during repairs initially missed.

Public Adjuster Licensing and Regulation

Public adjusters are licensed professionals, subject to state regulations and ethical guidelines. This adherence to professional standards and operational integrity ensures they are qualified to manage the complexities of insurance claims. The licensing process typically involves exams and background checks. This regulatory oversight assures policyholders that their public adjuster is knowledgeable, ethical, and working in their best interests.

The Complete Public Adjuster Service Breakdown

A public adjuster offers a wide range of services designed to help you get the most from your insurance claim. From the initial damage assessment to the final negotiation, the process requires specialized knowledge and attention to detail. Let's take a closer look at the key stages.

Initial Damage Assessment and Policy Review

The first step a public adjuster takes is a comprehensive assessment of the damage. This goes beyond the surface level. They might uncover hidden structural damage or anticipate future repair needs stemming from the initial incident. At the same time, they'll review your insurance policy, carefully examining the language to identify all applicable coverage. This two-pronged approach ensures that all potential claims are considered.

Detailed Documentation and Evidence Gathering

Thorough documentation is essential for a successful claim. Public adjusters meticulously document all damage, compiling a detailed inventory with photos, videos, and written descriptions. They also gather supporting evidence like contractor estimates, repair bills, and other relevant documents. This careful process builds a solid foundation for your claim.

Cost Estimation and Claim Preparation

Building a strong claim requires accurate cost estimation. Public adjusters use their industry experience to develop a comprehensive estimate that includes repairs, replacements, and additional living expenses. They understand local market prices for materials and labor and can anticipate potential hidden costs. This detailed cost estimation helps avoid underinsurance and ensures all damages are accounted for.

Contractor Coordination and Oversight

Public adjusters often work with contractors, making sure repairs are done correctly and meet the required standards. They serve as a link between you and the contractors, facilitating communication and ensuring the work aligns with the approved claim. This oversight safeguards your interests and helps the restoration process run smoothly. Check out our guide on managing your property damage claim.

Negotiation With the Insurance Company

A key role of the public adjuster is negotiating with the insurance company. They advocate for you, using their knowledge of insurance policies and negotiation strategies to secure the best possible settlement. They present a compelling case based on the documented evidence and cost estimates. This skilled negotiation helps ensure a fair settlement.

Final Settlement and Claim Resolution

The final stage involves reviewing the settlement offer and making sure it covers the documented damages and policy coverage. Public adjusters help you understand the settlement terms and guide you through the final steps of claim resolution. This ensures you receive appropriate compensation for your losses so you can begin rebuilding.

This comprehensive approach, combined with their understanding of the insurance industry, allows public adjusters to often secure higher settlements than policyholders might achieve on their own. This expertise is especially valuable when dealing with significant property damage, complex business interruption claims, or disputed coverage. Business owners might be interested in how to manage commercial claims.

When Public Adjusters Become Your Best Investment

Knowing when to hire a public adjuster can be a crucial decision after property damage. While not always necessary, certain situations greatly benefit from their expertise, potentially saving you considerable time, stress, and financial hardship. This section examines specific scenarios where a public adjuster can be your best investment.

Major Property Damage and Complex Claims

Navigating the claims process after significant property damage from events like major storms, fires, or floods can be overwhelming. Public adjusters excel in these situations, providing expert damage assessments, including often-overlooked hidden or future costs. Their knowledge of complex insurance policy language ensures you receive the full coverage you're entitled to, maximizing your potential settlement.

For example, after a major hurricane, homeowners often face extensive damage, including structural issues, water damage, and loss of personal belongings. A public adjuster can accurately document and assess the full extent of the damage, often leading to a significantly higher settlement. Public adjusters have become increasingly important for complex claims, particularly in areas prone to natural disasters.

Following Hurricane Katrina in 2005, public adjusters played a crucial role in helping homeowners navigate the complex claims process. Total damages reached approximately $125 billion, with many homeowners facing significant challenges securing fair compensation. Public adjusters assisted by assessing damage, determining coverage, and negotiating settlements, often securing larger payouts for their clients. Learn more about public adjusters and disaster relief.

Inadequate Insurance Company Offers and Disputes

Insurance company offers sometimes fall short of the actual cost of repairs or replacement. This can be due to various factors, including undervaluing the damage or disputes over policy coverage. A public adjuster acts as your advocate, skillfully negotiating with the insurance company to ensure a fair and just settlement. Their understanding of insurance law and negotiation tactics helps level the playing field, preventing policyholders from being pressured into accepting a lowball offer.

Commercial Claims and Business Interruption

Commercial claims often involve intricate policies and substantial financial losses, especially when business interruption occurs. Public adjusters specializing in commercial claims understand these complexities. They accurately assess the impact on your business operations and negotiate for maximum coverage, including lost income and extra expenses. You might be interested in: How to master commercial claims.

Multiple Damage Types and Specialized Expertise

When damage involves multiple types, such as combined fire and water damage, determining coverage and assessing the full extent of the loss becomes even more challenging. A public adjuster with expertise in handling combined claims ensures all aspects of the damage are considered. They often bring in specialized experts like engineers or contractors to provide additional documentation and support for your claim.

This thorough approach strengthens your case for a fair and comprehensive settlement, minimizing the risk of underinsurance. Their involvement can make a substantial difference in your financial recovery, allowing you to rebuild your life and business effectively.

Public Adjuster Fees: What You'll Actually Pay

Understanding compensation structures is crucial when deciding whether to hire a public adjuster. This section breaks down the typical fee arrangements so you can determine if professional representation fits your financial situation.

Common Fee Structures

Most public adjusters work on a contingency fee basis. This means they receive a percentage of your final insurance settlement. This percentage usually ranges from 5% to 15%, varying based on the claim's complexity and state regulations. A simple claim might incur a lower percentage, while a complex commercial claim could be at the higher end.

Less common are flat-rate fees or hourly billing. Flat-rate fees are generally for smaller, simpler claims. Hourly billing typically applies to specific tasks within a larger claim, like policy review or targeted case consultations.

Understanding Fair Pricing and Contractual Considerations

Recognizing fair pricing is essential. Several factors influence the fee, including claim complexity, estimated time investment, and the adjuster's experience. A clear, written contract outlining all fee-related details is vital.

The following table, "Public Adjuster Fee Structure Breakdown," provides a comprehensive overview of common compensation models, their typical ranges, ideal applications, and key advantages and disadvantages.

| Fee Type | Typical Range | Best For | Pros | Cons |

|---|---|---|---|---|

| Contingency Fee | 5% – 15% of settlement | Most claims, especially complex ones | No upfront cost; adjuster incentivized to maximize settlement | Adjuster's fee increases with settlement amount; may not be cost-effective for small claims |

| Flat-Rate Fee | Varies based on scope of work | Smaller, straightforward claims | Predictable cost | May not be suitable for complex claims; adjuster may rush the process |

| Hourly Rate | Varies based on adjuster's experience | Specific tasks or consultations | Suitable for limited engagements; clear understanding of costs for each hour worked | Can become expensive for extensive claims; requires careful monitoring of hours billed |

This table helps illustrate the different fee structures and their suitability for various claim types. Understanding these differences allows for informed decision-making when choosing a public adjuster.

Red Flags and Negotiation

Be cautious of unusually high or low fees. Extremely low fees might suggest inexperience, while excessively high fees could indicate exploitation. Remember, fees are negotiable. Discuss your budget and request contract adjustments. Reputable adjusters will be open to finding a mutually beneficial arrangement.

Financial Considerations and Professional Representation

Assessing the financial viability of hiring a public adjuster requires careful consideration. Weigh the potential settlement increase against the adjuster's fee. For simple claims, self-representation might suffice. Complex claims, especially those involving significant sums or intricate policy language, often benefit from professional expertise. Even with their fee, a public adjuster's skill in navigating claim complexities and maximizing your settlement can result in a greater net recovery.

Choosing Your Public Adjuster: Selection Strategies

Finding the right public adjuster is crucial after understanding their benefits and fees. Not all adjusters are the same, and selecting the best one for your needs requires careful thought. This guide provides the essential criteria for evaluating potential representatives.

License Verification and Experience

First, verify the adjuster's license. Each state has specific licensing requirements, so ensure the adjuster is licensed in your state. This is critical. Next, assess their experience. How long have they been working as a public adjuster? Look for a proven history of successful claims, especially those similar to yours. Experienced adjusters possess the knowledge and skills to handle complex insurance claims.

Reputation Research and Client Testimonials

Research the adjuster's reputation. Online reviews and testimonials from past clients offer valuable insights into their professionalism, communication, and effectiveness. A solid reputation supported by positive client feedback is a strong indicator of a trustworthy adjuster.

Specialization and Local Market Knowledge

Consider the adjuster's specialization. Some focus on residential claims, while others handle commercial properties or specific damage types like fire or flood. Choosing an adjuster with relevant experience in your claim type is vital. Local market knowledge is also essential. An adjuster familiar with local building codes, construction costs, and insurance practices can significantly benefit your claim.

Communication Compatibility and Availability

Clear and prompt communication is essential throughout the claims process. Choose an adjuster who communicates effectively and responds to your questions and concerns promptly. Do they provide regular updates? A good communicator keeps you informed and involved at every stage.

Comparing Adjusters and Negotiating Contracts

Interview multiple adjusters before deciding. Prepare questions about their experience, fees, and approach. Comparing their responses helps you find the best fit. Once you've chosen an adjuster, review the contract carefully. Understand the fees, payment terms, and services covered. Negotiate terms that align with your situation and expectations.

Recognizing Red Flags

Be cautious of adjusters who make unrealistic promises or pressure you to sign a contract quickly. Avoid those with disciplinary actions or negative reviews. A trustworthy adjuster is transparent, ethical, and focused on achieving the best possible outcome for you.

By following these strategies, you can confidently select a public adjuster who will effectively represent your interests and guide you through the often-complicated insurance claims process, ensuring a smooth and successful resolution, allowing you to recover and rebuild after property damage.

Working With Your Public Adjuster: The Complete Process

Once you’ve chosen a public adjuster, understanding the collaborative process is crucial for a smooth and successful claim. This section provides realistic insights into what to expect, from the initial property assessment to the final settlement distribution.

Initial Contact and Property Assessment

The first step after hiring a public adjuster is a thorough property assessment. This goes beyond surface-level observations and involves a detailed inspection of all damaged property. The public adjuster documents everything meticulously on your behalf, creating a comprehensive inventory with photos, videos, and detailed descriptions. This detailed documentation serves as the foundation of your claim.

Policy Review and Coverage Analysis

Simultaneously, the public adjuster reviews your insurance policy. This involves analyzing the specific terms and conditions to determine the full extent of your coverage. This step is critical for identifying all applicable coverage and potential claims. For instance, some policies cover additional living expenses if your home becomes uninhabitable. Discovering these often-overlooked clauses can significantly affect your final settlement.

Documentation and Claim Preparation

The public adjuster compiles all the necessary documentation. This includes the damage inventory, the policy analysis, and any supporting evidence, such as contractor estimates and repair bills. A comprehensive cost estimation is also prepared, accounting for repairs, replacements, and potential additional living expenses. This thorough approach helps ensure all damages are considered.

Negotiation and Communication With the Insurance Company

Your public adjuster acts as your representative and handles all communication with the insurance company. They manage the negotiations, leveraging their expertise to advocate for your best interests. This typically involves presenting the documented evidence, explaining the cost estimations, and negotiating a fair settlement. This relieves you of the stress of direct interaction with the insurance company.

Settlement Review and Distribution

When the insurance company offers a settlement, your public adjuster reviews it with you to ensure it aligns with the documented damages and your policy coverage. They explain the settlement terms and guide you through the final steps of the claim resolution process. They will also assist with paperwork and confirm you receive the agreed-upon compensation.

Ongoing Support and Consultation

Often, public adjusters offer continued support even after the settlement is disbursed. This may include answering questions about the settlement or addressing any further issues that might arise. This ongoing support contributes to a smoother recovery process.

Managing Expectations and Challenges

The claims process, even with a public adjuster, can present challenges, such as delayed responses from the insurance company or disagreements about damage evaluations. Your public adjuster is prepared to handle such issues, working towards a positive resolution. Open communication between you and your adjuster is vital for effectively addressing these challenges.

By understanding the entire process of working with a public adjuster, you can better prepare for each stage, manage expectations, and ensure a more efficient and successful claim experience. This allows you to concentrate on recovering from the loss and rebuilding your life.

Key Takeaways

Navigating the complexities of property insurance claims can be a daunting task. This section offers key takeaways to help you make informed decisions about your claim and the potential advantages of working with a public adjuster. These insights highlight critical factors to consider, including claim complexity, financial implications, and warning signs that you might need professional guidance.

Assessing Claim Complexity

A simple claim, such as minor roof damage, might be manageable without professional help. However, larger, more complex claims involving substantial property damage or business interruption often benefit from the expertise of a public adjuster. For example, if your home experiences significant fire damage, a public adjuster's knowledge of building codes, repair costs, and policy intricacies can prove invaluable. This expertise helps ensure a fair settlement covering all necessary repairs and replacements.

-

Simple Claims: Minor damage, straightforward coverage, easily documented losses.

-

Complex Claims: Extensive damage, multiple damage types, complex policy language, business interruption losses.

Financial Considerations

While public adjusters do charge fees for their services, their expertise can often result in considerably higher settlements. This increase in the settlement amount can frequently offset their fee and lead to a greater net recovery for you. Conducting a cost-benefit analysis can help you decide if professional representation makes financial sense in your particular situation.

Realistic Expectations and the Claims Process

Hiring a public adjuster doesn't guarantee a problem-free claims process. Delays can still occur, particularly when dealing with insurance companies. However, a public adjuster acts as your advocate, navigating the intricacies of the claims process, facilitating communication, and working towards a timely resolution. They help manage expectations, provide realistic timelines, and keep you informed throughout the process.

Alternatives and Additional Resources

If you choose not to work with a public adjuster, several resources are available to assist you. Online guides, community organizations, and state insurance departments offer valuable information and support. However, these resources may not offer the same level of personalized advocacy and specialized expertise as a public adjuster.

Warning Signs You Need Professional Assistance

Certain situations strongly indicate the need for a public adjuster's services:

-

Disputed Claim: The insurance company denies your claim or significantly undervalues the damage.

-

Complex Policy Language: You have difficulty understanding your policy and the coverage it provides.

-

Overwhelming Paperwork: The claims process feels overwhelming due to the volume of paperwork and the time commitment required.

-

Significant Property Damage: Your property has sustained substantial damage from a fire, flood, or other catastrophic event.

This summary provides you with the necessary information to make an informed decision. A public adjuster can be a valuable asset, navigating the complexities of your claim, potentially maximizing your settlement, and allowing you to focus on recovery. Do you need help navigating a property insurance claim in Oregon or Washington? Contact NW Claims Management today for a free claim evaluation. Learn more about NW Claims Management and how they can assist you.