Level Up Your Insurance Claim: When to Call in the Pros

Filing an insurance claim after property damage is complex and time-consuming. This listicle outlines six key benefits of hiring a public adjuster, helping you decide if professional representation is right for you. Learn how a public adjuster can maximize your claim settlement, provide expert policy knowledge, reduce your stress, document damages professionally, skillfully negotiate with insurers, and often work on a contingency basis – offering significant advantages during a difficult time. Understanding the benefits of hiring a public adjuster can be crucial to receiving a fair settlement.

1. Maximized Claim Settlement Value

One of the most compelling benefits of hiring a public adjuster is the potential for a significantly larger insurance claim settlement. Public adjusters are licensed professionals who work exclusively for policyholders, not insurance companies. Their sole focus is to ensure you receive the maximum possible payout for your covered losses. Unlike insurance company adjusters, whose goal is often to minimize the insurer's expense, a public adjuster acts as your advocate, leveraging their expertise to navigate the complexities of the claims process and secure a fair settlement. This expertise can translate into substantially more money in your pocket, allowing you to properly repair or rebuild after a loss.

How does this work? Public adjusters bring a wealth of knowledge to the table. They are deeply familiar with policy language, coverage interpretations, and claim valuation techniques. They conduct independent property damage assessments, meticulously documenting every detail and ensuring that no covered damage is overlooked. This includes identifying hidden damages that a homeowner might miss, such as structural issues or damage to underlying systems. They then prepare a comprehensive claim documentation package and present it to the insurance company, expertly negotiating for a fair and just settlement. Their understanding of current replacement costs and market values ensures that your claim accurately reflects the true cost of recovery.

For residential homeowners in Oregon and Washington recovering from property damage, commercial property and business owners, municipalities, schools, and even nonprofit organizations, the complexities of navigating insurance claims can be overwhelming. Whether facing the aftermath of a fire, flood, storm, or vandalism, a public adjuster provides invaluable expertise.

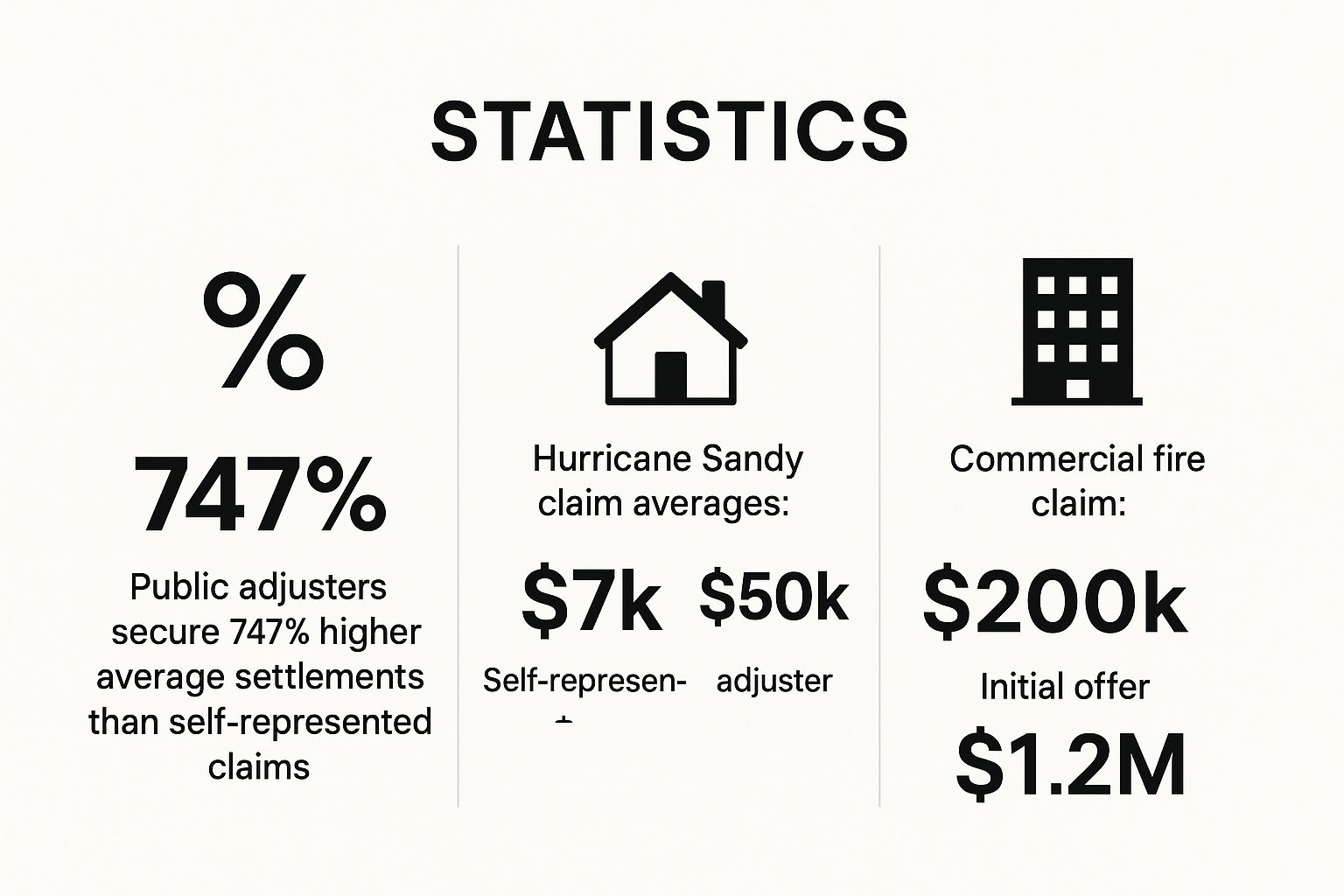

Several compelling examples illustrate the impact a public adjuster can have. Following Hurricane Sandy, victims who hired public adjusters received average settlements of $50,000, a stark contrast to the average $7,000 received by those who navigated the claims process alone. In another instance, a commercial property fire claim with an initial offer of $200,000 was ultimately settled for $1.2 million after the involvement of a public adjuster. Even seemingly smaller claims can benefit significantly: a water damage claim in Florida jumped from an initial offer of $15,000 to a final settlement of $85,000 with public adjuster representation. These examples demonstrate the substantial financial advantages of professional advocacy.

The following infographic visualizes key data points highlighting the significant difference in settlement values when a public adjuster is involved:

This infographic starkly illustrates the potential financial benefits of engaging a public adjuster. The 747% higher average settlement compared to self-represented claims, coupled with the specific examples of increased settlements after adjuster involvement, underscores the value of professional representation.

While the potential for maximized claim settlements is a primary benefit, it’s important to be aware of the costs involved. Public adjusters typically charge a fee based on a percentage of the final settlement amount, usually ranging from 10-20%. While this can be a substantial sum, it’s important to weigh it against the significantly higher settlement you are likely to receive. For very small claims, the adjuster’s fee might outweigh the increased settlement, making it less cost-effective. Additionally, involving a public adjuster may extend the overall claims process timeline.

To ensure a positive experience, take these steps: document all damage thoroughly with photos and videos before contacting a public adjuster. Obtain multiple recommendations and verify licenses. Critically, understand the fee structure and contract terms before signing any agreement. Finally, confirm the adjuster specializes in your specific type of claim. By taking these precautions, you can leverage the expertise of a public adjuster to maximize your claim settlement and ensure a smoother recovery process. A public adjuster's services are particularly valuable for those feeling overwhelmed by the complexities of insurance claims, those seeking swift and fair settlements, and individuals who simply desire an expert in their corner to maximize their policy payouts.

2. Expert Knowledge of Insurance Policies and Legal Requirements

One of the most compelling benefits of hiring a public adjuster lies in their specialized knowledge of insurance policies, legal requirements, and the often-complex claims process. Navigating the intricacies of insurance law and policy interpretation can be overwhelming for the average policyholder, especially when dealing with the aftermath of property damage. Public adjusters possess the expertise to effectively interpret your policy, identify all applicable coverages, and ensure your claim is handled in compliance with all legal and regulatory requirements. This specialized knowledge can significantly impact the outcome of your claim, potentially resulting in a substantially larger settlement. Learn more about Expert Knowledge of Insurance Policies and Legal Requirements

Insurance policies are notoriously dense documents filled with complex language, exclusions, and nuanced coverage details. Most policyholders lack the time, resources, and expertise to fully comprehend these intricate documents. A public adjuster, however, is trained to dissect and interpret this language, identifying every potential avenue for coverage that applies to your specific situation. They understand the subtle differences between different types of coverage, the implications of various exclusions, and how to effectively present your claim to maximize your recovery. This comprehensive understanding of policy language and exclusions is a critical advantage in the claims process.

Beyond policy interpretation, public adjusters also possess in-depth knowledge of state insurance regulations and legal requirements. They are familiar with the specific laws governing insurance claims in your area, including deadlines for filing, required documentation, and procedural guidelines. This knowledge ensures that your claim is handled correctly and within the stipulated timeframe, preventing costly mistakes that could jeopardize your settlement. Understanding and adhering to these legal requirements is often crucial for a successful claim outcome.

Furthermore, public adjusters have expertise in coverage interpretation and application. They can identify coverage options that policyholders might overlook, such as additional living expenses, code upgrade coverage, or business interruption coverage. For instance, a public adjuster might discover that your policy includes coverage for the cost of temporary housing while your home is being repaired, a benefit you may have been unaware of. This expertise can uncover hidden value within your policy, leading to a more comprehensive and fair settlement.

Their understanding of claim filing deadlines and procedural requirements is another key advantage. Missing a crucial deadline or failing to follow proper procedures can significantly impact your claim, even leading to a denial. A public adjuster meticulously tracks deadlines, ensures all necessary documentation is submitted correctly, and navigates the complexities of the claims process on your behalf. This meticulous attention to detail can safeguard your claim and prevent unnecessary delays or denials.

Finally, public adjusters are familiar with insurance company tactics and standard practices. They understand the strategies insurers often employ to minimize payouts and can effectively counter these tactics to ensure you receive a fair settlement. This experience in dealing with insurance companies levels the playing field, giving you an advocate who understands the intricacies of the insurance industry.

Pros of Utilizing a Public Adjuster's Expertise:

- Prevents costly mistakes: Their knowledge ensures accurate claim filing and documentation.

- Identifies overlooked coverage options: They can uncover benefits you might not be aware of.

- Ensures legal compliance: Adherence to deadlines and requirements is guaranteed.

- Levels the playing field: Their expertise counters insurance company tactics.

Potential Cons:

- Policy limitations: They may discover limitations that impact your expectations.

- Complex policies: Additional legal consultation might be necessary in some cases.

Examples of Successful Public Adjuster Intervention:

- A public adjuster identified $25,000 in additional living expenses coverage a homeowner was unaware of.

- A business interruption claim was successfully filed within the statute of limitations after an initial denial.

- Code upgrade coverage was utilized to bring a damaged property up to current building standards.

Tips for Working with a Public Adjuster:

- Provide complete policy documents to your adjuster.

- Ask for explanations of all relevant coverages and exclusions.

- Ensure your adjuster is licensed and maintains current continuing education.

- Request regular updates on regulatory deadlines and requirements.

By leveraging the expert knowledge and experience of a public adjuster, you can navigate the complex world of insurance claims with confidence, ensuring you receive the full benefits you are entitled to under your policy. Whether you are a homeowner dealing with fire damage, a business owner facing a business interruption, or a municipality navigating a complex claim, a public adjuster can provide invaluable assistance in maximizing your insurance settlement.

3. Time and Stress Reduction for Policyholders

One of the most significant benefits of hiring a public adjuster is the immense reduction in time commitment and stress levels for policyholders. Managing a property insurance claim is often a complex, arduous, and emotionally draining process, especially when dealing with the aftermath of devastating events like fires, floods, or storms. Juggling insurance company communications, damage assessments, paperwork, and repair coordination can quickly become overwhelming, diverting valuable time and energy away from personal recovery, business operations, or other critical priorities. Public adjusters step in to alleviate this burden, acting as dedicated advocates for policyholders and expertly navigating the intricacies of the insurance claims process.

A public adjuster takes on the complete management of the claim, from the initial filing to the final settlement. This comprehensive approach encompasses all communication with the insurance company, ensuring professional and effective dialogue. They coordinate necessary inspections with qualified experts, meticulously gather documentation to support the claim, and manage all related paperwork, ensuring regulatory compliance. Furthermore, they provide regular progress updates to keep policyholders informed and involved throughout the process. This dedicated support allows policyholders to focus on rebuilding their lives, resuming business operations, or attending to family needs, secure in the knowledge that their claim is receiving professional attention.

This time and stress reduction is invaluable for various individuals and organizations. For instance, a restaurant owner in Portland, Oregon, whose establishment suffered significant fire damage, was able to maintain limited business operations at a temporary location while their public adjuster handled the complex insurance claim, minimizing financial losses and preserving employee jobs. Similarly, an elderly homeowner in Seattle, Washington, overwhelmed by the complexity of a hurricane damage claim, found peace of mind knowing a public adjuster was managing every detail, allowing them to focus on their personal well-being. Working parents in Bend, Oregon, dealing with a devastating flood, were able to prioritize their children's needs and emotional recovery while their public adjuster expertly navigated the insurance claim process. These examples highlight the diverse situations where a public adjuster can significantly reduce the burden on policyholders.

Features of Time and Stress Reduction through a Public Adjuster:

- Complete Claims Management: From initial filing to final settlement, the adjuster handles every aspect.

- Professional Communication: All interactions with the insurance company are managed effectively and professionally.

- Inspection Coordination: The adjuster coordinates all necessary inspections and assessments.

- Documentation Management: All required paperwork and supporting documentation are meticulously gathered and organized.

- Regular Progress Updates: Policyholders receive regular updates, ensuring transparency and peace of mind.

Pros:

- Eliminates Time-Consuming Research and Paperwork: Policyholders are freed from the burden of navigating complex insurance procedures.

- Reduces Emotional Stress: Dealing with insurance companies after a loss can be incredibly stressful. A public adjuster acts as a buffer, minimizing emotional strain.

- Allows Focus on Recovery: Policyholders can concentrate on personal recovery, business continuity, or other essential priorities.

- Prevents Costly Delays or Mistakes: Professional handling of the claim helps avoid potential delays or errors that could impact the settlement.

- 24/7 Availability: Many public adjusters offer round-the-clock availability for urgent claim matters.

Cons:

- Less Direct Control over Claim Communications: While the adjuster manages communication, the policyholder may have less direct interaction with the insurance company.

- Requires Trust in Adjuster’s Decision-Making: Policyholders need to trust the adjuster's expertise and judgment in handling their claim.

- May Feel Disconnected from the Process: Some policyholders may prefer to be more directly involved in every aspect of the claim.

Tips for Maximizing the Benefits:

- Establish Clear Communication Expectations: Discuss communication preferences and frequency of updates upfront with your adjuster.

- Request Regular Progress Reports and Updates: Stay informed about the progress of your claim by requesting regular reports.

- Maintain Involvement in Major Decisions and Settlements: While the adjuster manages the process, remain involved in key decisions, especially regarding settlement offers.

- Keep Copies of All Important Documents and Correspondence: Maintain personal copies of all relevant documents for your records.

Hiring a public adjuster is particularly beneficial when dealing with complex or high-value claims, when the policyholder lacks the time or expertise to manage the process effectively, or when the insurance company's initial offer seems inadequate. By entrusting the claim to a qualified professional, policyholders can reclaim their time, reduce stress, and focus on what truly matters – their recovery and well-being.

While there is no website link provided to include, policyholders are encouraged to research reputable public adjusting firms in their area. Ask for referrals, check online reviews, and verify licensing and credentials before making a decision. Choosing the right public adjuster can make a significant difference in the outcome of your claim.

4. Professional Damage Assessment and Documentation

One of the most significant benefits of hiring a public adjuster lies in their expertise in professional damage assessment and documentation. When disaster strikes, accurately assessing the full extent of the damage to your property can be overwhelming and complex. This is where a public adjuster’s specialized knowledge becomes invaluable, particularly when navigating the often-confusing insurance claims process. They provide a crucial service by meticulously documenting every detail of the damage, ensuring you receive a fair settlement from your insurance company. This thorough approach not only strengthens your claim but also prevents potential disputes down the line, saving you time, stress, and potentially thousands of dollars.

A public adjuster’s damage assessment goes far beyond a superficial visual inspection. They utilize industry-standard methods and tools to uncover both visible and hidden damages, employing a systematic approach that leaves no stone unturned. This comprehensive property damage inspection begins with a thorough walkthrough of the affected areas. They meticulously document all visible damage, taking detailed photographs and precise measurements. Furthermore, they use specialized tools like moisture meters and thermal imaging cameras to detect hidden issues like water intrusion behind walls, under floors, or within ceilings. These tools can also pinpoint potential mold growth and identify structural damage that might otherwise go unnoticed. This is particularly important in cases of fire damage, where structural integrity may be compromised, or after floods, where lingering moisture can lead to extensive mold issues.

The information gathered during this in-depth assessment is compiled into a comprehensive report. This report serves as a crucial piece of evidence when filing an insurance claim. It includes detailed descriptions of all damages, supported by professional photographs, precise measurements, and readings from specialized equipment. This professional presentation significantly strengthens the credibility of your claim and provides concrete evidence to support your requested settlement amount. Learn more about Professional Damage Assessment and Documentation This documentation also creates a permanent record for future reference, should any issues arise later.

Consider these real-world examples illustrating the power of professional damage assessment: in one case, thermal imaging revealed hidden water damage behind the walls of a seemingly dry home, adding an additional $30,000 to the claim. In another, a structural damage assessment identified critical foundation issues initially missed by the insurance company’s adjuster, preventing further damage and ensuring proper repairs. And in yet another scenario, early mold detection by a public adjuster not only prevented potential health hazards for the occupants but also secured additional remediation coverage from the insurance company.

While hiring a public adjuster offers significant advantages, it’s important to be aware of potential drawbacks. For instance, the initial assessment may reveal more extensive damage than you initially anticipated, which can be emotionally challenging. Additionally, professional documentation requires time and expertise to complete properly, so the process may take longer than a simpler assessment. However, the long-term benefits of a thorough assessment far outweigh these temporary drawbacks.

To maximize the effectiveness of a professional damage assessment, consider the following tips: Resist the urge to attempt repairs before the assessment is complete, as this can compromise the evidence. Whenever possible, preserve damaged items for inspection. While it’s a good idea to take your own photos for personal records, don't rely solely on them for the insurance claim. Finally, don’t hesitate to ask your public adjuster to explain their assessment methodology and findings to ensure you understand the full scope of the damage.

By leveraging the expertise of a public adjuster for professional damage assessment and documentation, you're not just hiring someone to fill out forms; you're securing a dedicated advocate who will meticulously document every detail to ensure you receive the full and fair settlement you deserve. This is a crucial benefit of hiring a public adjuster, especially when dealing with the complexities of insurance claims after significant property damage. Whether you are a residential homeowner in Oregon or Washington, a commercial property owner, a municipality, or a non-profit organization, a public adjuster can be your crucial ally in navigating the often-challenging world of insurance claims. They provide the expertise and support you need to recover from property damage efficiently and effectively, maximizing your policy payout and allowing you to focus on rebuilding.

5. Skilled Negotiation with Insurance Companies

One of the most significant benefits of hiring a public adjuster lies in their expertise in negotiating with insurance companies. Navigating the complexities of insurance policies and the claims process can be overwhelming, especially when you're dealing with the emotional and financial aftermath of property damage. Public adjusters act as your dedicated advocate, leveraging their deep understanding of insurance company tactics, decision-making processes, and settlement strategies to secure the best possible outcome for you. They level the playing field, ensuring you're not at a disadvantage when dealing with seasoned insurance professionals. This expert representation is invaluable in maximizing your claim settlement and relieving the stress of battling the insurance company on your own.

Public adjusters possess professional negotiation skills honed through years of experience. They understand the intricacies of insurance policies, the nuances of claim evaluation, and the priorities of insurance companies. This knowledge allows them to present your claim in a compelling and professional manner, meticulously documenting damages, accurately assessing losses, and effectively communicating the full extent of your claim. They know how to build a strong case, supporting it with evidence and industry standards, to justify a fair and equitable settlement. Learn more about Skilled Negotiation with Insurance Companies

Their ability to present claims effectively is a key advantage. Rather than simply submitting a list of damaged items, public adjusters compile a comprehensive claim package that includes detailed descriptions, supporting documentation, and professional valuations. This thorough approach increases the credibility of your claim and compels insurance companies to take it more seriously. They have the knowledge to accurately assess settlement ranges and market standards, ensuring you're not being shortchanged.

Moreover, established relationships with insurance professionals often lead to more respectful treatment and serious consideration of your claim. Public adjusters know who to contact within the insurance company to escalate issues and reach appropriate decision-makers, facilitating a smoother and more efficient claims process. They also understand the delicate balance of when to accept a settlement and when to continue negotiating for a better offer, using their experience to strategize and maximize your recovery.

While the negotiation process may sometimes extend the settlement timeline, and some insurance companies may initially resist higher settlements, the potential for significantly higher settlement amounts far outweighs these considerations. For example, a public adjuster might successfully negotiate an initial $50,000 settlement offer to $150,000 through persistent professional advocacy. In a commercial setting, effective presentation of business interruption losses could result in a settlement increase of $500,000. Even a denied claim could be overturned and settled for $75,000 through strategic negotiation.

Whether you're a residential homeowner in Oregon or Washington recovering from property damage, a commercial property owner seeking a swift and fair settlement, a municipality navigating a complex claim, or simply feeling overwhelmed by the insurance claims process, a public adjuster can be your invaluable ally. Their negotiation skills are particularly beneficial for those facing significant losses or complex claims where maximizing the insurance payout is crucial.

Here are a few tips to maximize the effectiveness of your public adjuster's negotiation efforts:

- Don't accept initial settlement offers before consulting a public adjuster. These initial offers are often lower than what you're entitled to.

- Provide all requested documentation promptly to support the negotiation process. This includes photos, receipts, invoices, and any other relevant information.

- Trust your adjuster's strategic timing and approach. They have the experience to know when to push for more and when to accept a reasonable offer.

- Understand that good negotiations take time and patience. While you understandably want a quick resolution, allowing your adjuster the necessary time to negotiate effectively will often result in a significantly higher settlement.

6. Contingency-Based Fee Structure with No Upfront Costs

One of the most compelling benefits of hiring a public adjuster, especially when facing the daunting task of navigating a property damage claim, is their contingency-based fee structure. This arrangement offers significant advantages, particularly for those struggling with the financial implications of a disaster. It essentially eliminates the financial barrier to accessing professional claims assistance, making it a crucial consideration for residential homeowners in Oregon and Washington, commercial property owners, municipalities, and even non-profit organizations dealing with complex insurance claims after fire, flood, storm, or vandalism.

So, how does it work? A contingency fee agreement means that the public adjuster's compensation is directly tied to the successful outcome of your claim. They only get paid if they recover money for you. This eliminates the need for any upfront fees, retainers, or hourly charges. Instead, the adjuster’s fee is calculated as a percentage of the final settlement amount secured from the insurance company. This percentage typically ranges from 10-20%, and is often negotiable depending on the complexity of the claim. This arrangement offers immediate access to professional representation without having to worry about immediate out-of-pocket expenses, a boon for policyholders already grappling with financial hardship due to property damage.

This "no win, no fee" structure intrinsically aligns the adjuster's interests with yours. Their motivation becomes maximizing your settlement, as a larger recovery for you translates directly into a larger fee for them. This incentivizes the adjuster to thoroughly investigate your claim, accurately assess the damages, and negotiate aggressively with the insurance company on your behalf. This shared goal is a cornerstone of the contingency fee system and represents a key advantage of hiring a public adjuster.

Consider these examples demonstrating the power of contingency fees in action:

-

Scenario 1: A homeowner suffered significant fire damage. Negotiating on their own, they secured a $30,000 settlement offer from their insurance company. Overwhelmed and unsure if this was a fair amount, they consulted a public adjuster. The adjuster, working on a 15% contingency fee, ultimately negotiated a $100,000 settlement. While the adjuster's fee was $15,000, the homeowner still netted $85,000 – significantly more than their initial $30,000.

-

Scenario 2: A small business faced potential bankruptcy after a major flood devastated their premises. Lacking the funds for upfront legal or adjusting fees, they engaged a public adjuster on a contingency basis. The adjuster successfully secured a settlement that not only covered the damages but also business interruption losses, allowing the business to recover and avoid closure. The contingency fee structure provided access to crucial professional help they otherwise couldn't have afforded.

These examples highlight the potential for a public adjuster, working on contingency, to not only cover their fee but also deliver a significantly larger net settlement than a policyholder could likely achieve on their own. Furthermore, the absence of upfront costs makes professional representation accessible even during times of financial strain, a benefit that resonates with many facing the aftermath of property damage.

However, it’s important to be aware of the potential drawbacks. While highly advantageous in many situations, contingency fees might not be the best option for very small claims. The percentage fee, though earned, can be a substantial sum on large settlements. It's essential to remember that your net payout will be reduced by the agreed-upon percentage.

Before hiring a public adjuster, follow these essential tips:

- Transparency is Key: Thoroughly understand the fee structure and percentage before signing any agreement. Don't hesitate to ask questions.

- Negotiate: The fee percentage is often negotiable, particularly for complex or high-value claims.

- Contract Clarity: Ensure the contract clearly specifies the services included in the fee.

- Cost-Benefit Analysis: Calculate the potential net benefit (settlement minus fee) to ensure hiring a public adjuster is financially advantageous for your specific situation.

Contingency-based fee structures are a critical factor when considering the benefits of hiring a public adjuster. They offer a risk-free path to professional assistance, aligning the adjuster’s incentives with your own and providing access to expertise that can significantly impact your financial recovery after a loss. While it's crucial to weigh the pros and cons and understand the fee implications, this payment model provides a vital lifeline for many navigating the complex world of insurance claims.

Key Benefits Comparison of Hiring a Public Adjuster

| Benefit | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐⚡ |

|---|---|---|---|---|---|

| Maximized Claim Settlement Value | Moderate – requires expertise in claim processes | Skilled public adjuster, documentation support | Significantly higher settlements (up to 747% more) | Large or complex claims with high damage | Higher payouts; expert negotiation; no upfront costs ⭐⚡ |

| Expert Knowledge of Policies & Law | High – deep knowledge of policies and regulations | Licensed adjuster with legal and regulatory expertise | Accurate claim filings, compliance with deadlines | Claims with complex policies or legal nuances | Prevents costly errors; identifies hidden coverage ⭐ |

| Time and Stress Reduction | Low to Moderate – adjuster manages claim process | Public adjuster handles coordination and communication | Reduced stress and time spent; seamless claim management | Policyholders needing relief from claim burden | Saves time; reduces stress; professional claim handling ⚡ |

| Professional Damage Assessment | Moderate – requires specialized tools and expertise | Equipment for thorough inspections (thermal, moisture) | Comprehensive, credible damage documentation | Cases with hidden or extensive damage | Accurate damage records; prevents disputes; thorough ⭐ |

| Skilled Negotiation with Insurers | Moderate to High – requires negotiation skills | Experienced negotiator familiar with insurer tactics | Increased settlement amounts through professional negotiation | Lowball or initially denied claims | Better settlements; industry relationships; claim credibility ⭐ |

| Contingency-Based Fee Structure | Low – straightforward payment terms | Contract outlining fees; contingent on settlement | No upfront costs; payment only on successful settlement | Policyholders with limited upfront funds | Risk-free; incentivizes adjuster; accessible representation ⚡ |

Ready to Get the Most Out of Your Insurance Claim?

Navigating the aftermath of property damage is stressful enough without the added burden of a complex insurance claim. This article has highlighted the numerous benefits of hiring a public adjuster, including maximizing your claim settlement value, leveraging expert knowledge of insurance policies and legal requirements, saving you valuable time and stress, ensuring professional damage assessment and documentation, and skillfully negotiating with insurance companies. Perhaps one of the most compelling benefits of hiring a public adjuster is the contingency-based fee structure, meaning no upfront costs for you. By understanding and utilizing these advantages, you can significantly improve your chances of receiving a fair and just settlement that reflects the true extent of your losses, whether you're a homeowner, business owner, or a municipality navigating a complex claim after a fire, flood, storm, or vandalism.

Mastering the insurance claims process is crucial for recovering what you deserve. A public adjuster acts as your advocate, working tirelessly on your behalf to ensure you receive the maximum possible payout allowed by your policy. Don't face this challenging process alone. Contact NW Claims Management, a licensed public adjusting firm serving Oregon and Washington, for a free claim evaluation today. NW Claims Management embodies the benefits of hiring a public adjuster, providing expert guidance and support throughout the entire process to help you recover what you deserve. NW Claims Management