When Your World Gets Turned Upside Down

That awful moment you find damage to your home…it can feel like the world's ending. I've been there, and I've talked to countless homeowners who've felt that same gut-wrenching panic. The ones who handle the insurance claim process best? They're not necessarily the most organized, they're the ones who take a deep breath and act quickly in those first few crucial hours.

Let me tell you about Sarah from Portland. A pipe burst in her kitchen at 2 AM, and she was standing in ankle-deep water. But even then, she did three smart things: shut off the main water line, grabbed her phone and documented everything, and then called her insurance company – before even thinking about calling a plumber.

Why that order? Because stopping more damage is priority number one. Imagine if she’d called a plumber first. An hour explaining the situation, another hour waiting… that’s two hours of water flowing, making things way worse, and possibly even affecting her claim. By quickly shutting off the water, Sarah protected her property and showed her insurer she was taking responsible action. And those initial photos and videos? Invaluable. They're a record of the damage before any cleanup, setting a clear baseline for the claim.

What’s an Emergency Repair?

An emergency repair is anything you absolutely have to do to prevent further damage and keep everyone safe. Boarding up a smashed window after a storm, throwing a tarp over a leaky roof, or turning off the gas after a fire – those are all good examples. And keep every single receipt! They're part of your claim and you can get reimbursed. Just don't make any permanent repairs before the adjuster comes out. You want them to see the full extent of the damage firsthand.

Photography Tips

Think like an insurance adjuster. They need a clear picture of the damage as a whole, and detailed shots of individual items. A wide shot of your flooded basement is helpful, but close-ups of that ruined sofa, your damaged electronics, and even personal belongings are just as important. Capture labels, model numbers, anything that helps identify what’s been affected. This makes the inventory process so much easier later on. Remember, settling a claim can take anywhere from 15 to 45 days on average, sometimes longer depending on what happened – think wildfires or other large-scale events. Good documentation speeds things up. Discover more insights about insurance claim timelines.

You’re not alone in this. If you’re in Oregon, for example, check out resources like Oregon Residential Public Adjuster for extra help. Those first 24 hours are key, but the entire claim process can be a headache. Having support can make all the difference.

Having The Conversation That Sets Everything In Motion

That first call to your insurance company after discovering home damage? It’s everything. Seriously. It sets the tone for your entire claim. Think of it like the opening scene of a movie – it sets the stage for everything that follows. You're not just reporting an incident; you're starting a collaborative investigation.

I remember when my friend Maria in Dallas discovered a burst pipe. On her first call, she mentioned she "probably should have replaced those old pipes years ago." She thought she was being honest, but that comment gave the adjuster an opening to blame the damage on "lack of maintenance," which ended up hurting her settlement. This is a perfect example of why choosing your words carefully is so important.

On the other hand, my buddy Tom in Seattle had similar water damage. He stuck to the facts during his initial call: when he discovered the leak, the steps he took (like shutting off the water), and the visible damage. Keeping it factual helped his claim go much smoother.

Understanding Your Audience

Insurance reps are listening for key pieces of information: the type of damage, when it happened, and what you’ve done about it. They're also sizing you up, trying to gauge your credibility. Clear, concise information, without speculation or self-blame, makes you a reliable source.

Here's what you should be asking during that first call:

- What’s my claim number? You’ll need this to track everything.

- What’s the next step? This helps you understand the process and sets clear expectations.

- Who is my contact person? Having a go-to person streamlines communication.

- When will an adjuster visit? Knowing this helps you prepare and gather necessary documentation.

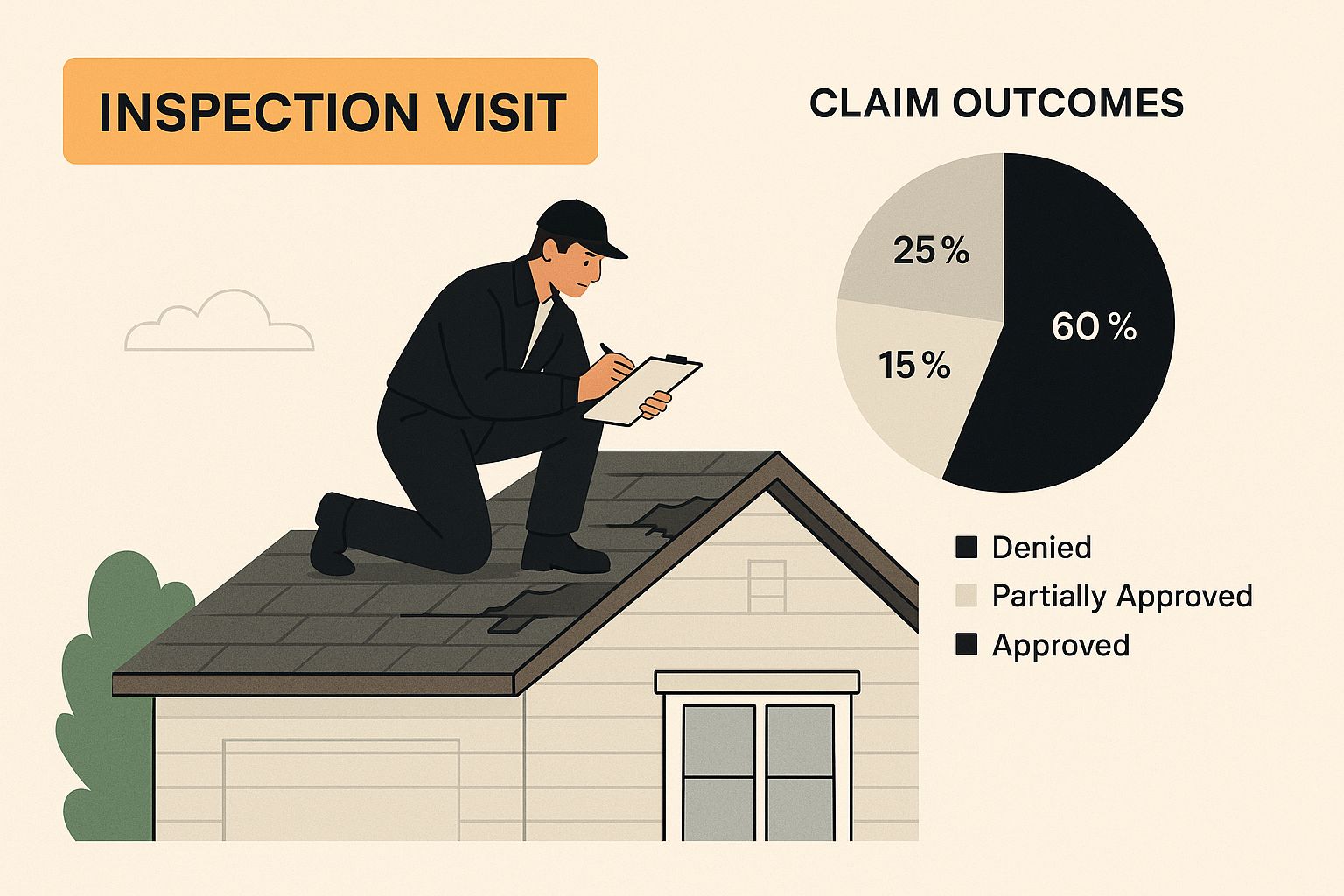

This infographic shows what a typical adjuster visit looks like. See how important good documentation is? The adjuster’s assessment is a huge factor in your claim’s outcome.

Documenting Everything From Day One

Documentation is your best friend throughout this process. Keep a detailed log of every interaction – calls, emails, everything. Include dates, times, names, and a brief summary of what was discussed. This log can be a lifesaver if any disagreements pop up later. For more on navigating insurance claims, check out NW Claims Management.

It might seem like a lot, but trust me, a little organization upfront saves a ton of headaches later. It turns the claim process from a confusing mess into a clear path toward recovery. And after dealing with property damage, you deserve a straightforward process.

Here's a handy guide to help you nail that initial call:

| Situation | What to Say | What NOT to Say | Why It Matters |

|---|---|---|---|

| Describing the damage | "I discovered water damage in the kitchen ceiling on July 12th. It appears to be coming from the bathroom above." | "I think the pipe burst sometime last week, but I'm not sure. Maybe it was the old plumbing." | Sticking to the facts helps avoid speculation, which can be used against you. |

| Explaining your actions | "I immediately shut off the main water valve and contacted a plumber to assess the damage." | "I panicked and tried to clean up the mess myself. I probably made it worse." | Demonstrating proactive steps shows responsibility and prevents further damage. Admitting fault can jeopardize your claim. |

| Asking about next steps | "What is the claim process, and what should I do next?" | "So, when do I get my money?" | Showing interest in the process fosters collaboration. Demanding a payout can appear impatient and unreasonable. |

| Discussing the cause | "The plumber believes the damage was caused by a burst pipe due to freezing temperatures." | "I'm sure this is covered, right? It wasn't my fault." | Providing professional opinions strengthens your claim. Assuming coverage and avoiding responsibility can raise red flags. |

This table highlights the importance of clear and factual communication during your initial claim call. Using the right language can significantly impact your claim’s outcome. Being prepared and knowing what to say – and what not to say – can make all the difference.

Making Your Adjuster Visit Count

The day your insurance adjuster shows up is a big deal. It's the day your claim essentially gets its price tag. But I've seen so many homeowners treat this visit casually, like it's just a quick walkthrough. Trust me, it's a crucial business meeting, and the way you handle it can dramatically impact your final payout.

This screenshot from Wikipedia really drives home the professional nature of an adjuster’s role. This isn't a casual chat; it’s a formal process with real consequences. Their evaluation directly affects your settlement.

Let me tell you about Jennifer in Phoenix. She spent three hours with her adjuster, painstakingly going through every single damaged room. She had a detailed inventory, even before-and-after photos on her tablet. That preparation paid dividends. Her settlement covered all the repairs and her temporary housing.

Then there’s Mark. He thought the adjuster would magically "find everything." He ended up with an assessment that missed $8,000 in hidden water damage behind his walls. A painful and expensive lesson. These stories show just how much your approach matters.

Preparation is Key: Documentation and Organization

So, how do you make the most of your adjuster visit? It all comes down to being organized. Think of it like preparing for an important presentation. You wouldn’t walk into a boardroom unprepared, right? Same principle applies here.

- Gather Your Documentation: Have your insurance policy, photos, videos, receipts, and any contractor estimates on hand. A neat binder shows you’re serious and makes a great impression.

- Create a Detailed Damage List: Don’t just gesture vaguely. Have a written list describing each damaged item and its estimated value. This keeps things clear and helps ensure nothing gets missed.

Don't Overlook the Hidden Damage

Adjusters are good at spotting obvious damage, but hidden problems are easily overlooked. Think water damage behind walls or under floors—those often need a closer look. Don't hesitate to point these areas out and suggest further inspection if you think it's necessary. This is where those pre-claim photos and videos you took right after the incident become invaluable.

Advocating For Your Position

Sometimes, you’ll disagree. If you think the adjuster missed something or undervalued an item, speak up! Be respectful, but firm. Present your evidence and explain your reasoning. This isn't about being confrontational; it’s about getting a fair assessment. If you're feeling overwhelmed, you might want to consider professional help for managing your insurance claim.

Considering a Public Adjuster

If the damage is extensive or the whole process is just too much, think about hiring a public adjuster. They work for you, not the insurance company. They handle everything from documenting the damage to negotiating your settlement. It can be a worthwhile investment, particularly in complex cases.

A successful adjuster visit truly depends on your preparation. By being organized, proactive, and ready to advocate for yourself, you’ll greatly improve your chances of a fair and complete settlement. You can turn a potentially stressful situation into a positive step toward getting your life back on track.

Building Your Bulletproof Paper Trail

Good documentation after a home disaster isn't about snapping a few quick phone pics—it's about building a rock-solid record of the damage. Think of it like laying the foundation for a strong insurance claim, brick by brick. Every photo, receipt, and email becomes a crucial piece of evidence.

I know a teacher in Atlanta, Lisa, who learned this the hard way when her basement flooded. Instead of panicked snapshots, Lisa methodically documented everything. She took wide shots to show the overall mess, close-ups of damaged items, and even created detailed lists with original purchase info. When the insurance company offered her a lowball settlement, Lisa’s detailed records helped her negotiate a much fairer outcome. She got the replacement cost she deserved, all thanks to her thorough documentation.

Photographing For Success: More Than Just Snapshots

Let's talk photos. Angle matters. Imagine you're a detective building a case. Capture the damage from multiple angles. Wide shots establish the scene, while close-ups highlight the nitty-gritty details. Say your hardwood floors buckled from water damage. A wide shot shows the general area, but a close-up captures the actual warping – powerful visual evidence. Don't forget to photograph labels, model numbers, and serial numbers. These prove ownership and value.

Receipts, Estimates, and Expenses: Tracking the Money Trail

Pictures are just the beginning. Keep a detailed record of every expense tied to your claim: contractor estimates, repair bills, receipts for temporary housing, even meals if you're displaced. I know it's a headache during a stressful time, but trust me, these costs add up quickly. Speaking of rising costs, have you noticed how home insurance premiums have skyrocketed lately? These increasing premiums have a big impact on the claims process and what policyholders experience. Learn more about rising insurance premiums. This makes maximizing your legitimate claim payout even more important.

What If You’ve Lost Receipts?

Don’t sweat it. Lost receipts don’t mean you're out of luck. Credit card statements, bank records, and even photos of the items in your home before the damage can help prove ownership and value. Online retailer accounts often have purchase histories, too. This whole experience taught me a valuable lesson about backing up important financial records – something I wish I'd done sooner!

Documenting the Hidden Costs

So many people overlook the hidden costs that come with a claim. Did you have to take time off work? Did you have extra travel expenses because of temporary housing? These are legitimate claim expenses, so track them! Even small costs like mileage and parking add up.

Creating this detailed paper trail is your best defense against lowball offers and denied claims. It puts you in a strong position to negotiate and recover what you're entitled to. This isn't just about paperwork; it’s about regaining control and peace of mind.

Turning Settlement Offers Into Fair Payouts

That first settlement offer hits your inbox, and you feel a wave of relief. Finally, the money to put things right! Don’t celebrate just yet. Anyone who’s been through this before knows that initial offer rarely reflects the full picture. My friend David in Minneapolis learned this the hard way. His initial offer seemed reasonable until he discovered it was based on actual cash value (ACV), not replacement cost value (RCV). This left him a staggering $12,000 short of what he needed for repairs. He fought back, providing his policy details and market data for comparable repairs, and ultimately negotiated an extra $9,500.

So, what can you learn from David’s experience?

Decoding Your Policy: ACV vs. RCV

The difference between ACV and RCV is essential to grasp during a home insurance claim. ACV considers depreciation. This means the insurer pays you what your damaged items were worth at the time of the loss, considering wear and tear. RCV, however, covers the cost of replacing your items with brand-new equivalents. That’s a substantial difference, especially with older belongings.

Challenging Depreciation: Don't Accept Lowball Offers

Insurance companies tend to be pretty aggressive when calculating depreciation. Don’t hesitate to challenge their figures. Back up your argument with evidence of current market value for similar items. Think online listings, appraisals – anything concrete. A well-supported case gives you negotiating power.

Understanding Exclusions: Knowing What's Covered

Every policy has exclusions – things it simply won't cover. Some are obvious, like flood damage if you haven’t got flood insurance. But others can be more nuanced. If you think an exclusion is being applied unfairly, don’t back down. Examine your policy wording carefully; you might find your damage is covered. For commercial properties, resources like those from NW Claims Management can be invaluable.

Negotiating Like a Pro: Tips and Strategies

Negotiating with insurance companies is a delicate balance. Here’s my advice:

- Be polite but firm: You're not enemies, but you need to stand up for yourself.

- Document everything: Keep a record of every conversation, email, and piece of supporting evidence. A clear paper trail is essential.

- Leverage contractor estimates: Get multiple estimates from reputable contractors to prove the real repair costs.

- Consider partial payments: If you need money fast, a partial payment can help. But ensure it doesn’t affect your ability to negotiate the full amount later.

Knowing When to Hold Out

Sometimes, it’s better to wait for a proper settlement than accept a quick, but insufficient offer. This is especially true with major damage. Carefully weigh up the immediate benefits versus the potential long-term gains.

Making Informed Decisions: Partial vs. Comprehensive Settlements

To help you weigh these decisions, here’s a handy table:

Common Settlement Calculation Methods and What They Mean

Understanding different valuation approaches and how they affect your payout

| Calculation Method | What It Means | When It's Used | Impact on Your Payout |

|---|---|---|---|

| Actual Cash Value (ACV) | Considers depreciation; pays the current value of damaged items | Often the initial offer; undervalues older items | Lower payout |

| Replacement Cost Value (RCV) | Covers the cost of replacing items with new equivalents | After challenging ACV and providing supporting documentation | Higher payout; reflects true replacement costs |

This table clearly shows the difference between settling for ACV and pushing for the RCV you’re entitled to.

Evaluating a settlement offer is a meticulous process – every detail counts. By understanding your policy, challenging unfair depreciation, and negotiating strategically, you can transform that initial offer into a fair settlement. Don't settle for less than what you deserve.

When You Need To Fight Back

Sometimes, even with your best prep work, your home insurance claim just doesn't go as planned. Maybe the insurance company denies the claim completely, or maybe their settlement offer is ridiculously low. Knowing how to push back effectively can make all the difference in getting what you deserve.

I’ve seen this firsthand. I remember working with Rachel in Colorado. Her insurer denied her roof leak claim, saying it was "gradual damage." But Rachel knew better. She’d seen the damage after a particularly nasty storm. She wasn’t about to let them get away with it. She pulled together everything she could: weather reports for her area, estimates and reports from roofing contractors, and photos clearly showing the damage. It took time and effort, but after six months and appealing through her state insurance department, she got her claim paid. Her persistence, combined with rock-solid documentation, was the key.

Escalation Options: Knowing Your Rights

So, what can you do when your claim hits a snag? First, you need to understand how to escalate the issue. Most insurance companies have an internal appeals process. This is your first step. Lay out exactly why you disagree with their decision, and back it up with evidence. Think like Rachel—clear, concise, and compelling documentation is your friend.

If the internal appeal doesn’t work, contact your state's insurance department. They can investigate the complaint and act as a mediator between you and the insurer. This can be incredibly helpful in resolving disputes. Insurance companies are regulated at the state level, so using your state’s resources is a powerful tool.

Legal Action and Alternative Dispute Resolution

Sometimes, even getting the state involved isn’t enough. In those cases, you might want to talk to a lawyer who specializes in insurance claims. They can advise you on your legal rights and represent you in negotiations or, if necessary, in court. Keep in mind, though, legal action can be expensive and time-consuming, so weigh the potential costs against what you might gain.

You also have other options, like mediation and arbitration. With mediation, a neutral third party helps you and the insurer find a solution you both agree on. Arbitration is a bit more formal: a neutral arbitrator hears both sides and makes a decision that’s legally binding. Both of these options can be faster and less expensive than going to court. NW Claims Management offers more information about navigating difficult claim situations.

Recognizing When You Need Professional Help

Navigating the appeals process can get complicated. Here are some signs you might want to seek professional help:

- Complex policy language: If you're struggling to understand the legal jargon in your policy, an attorney or public adjuster can translate it into plain English.

- Unreasonable delays: If the insurance company keeps stalling, a professional can help get things moving again.

- Significant discrepancies: If the settlement offer is way less than your estimated damages, an expert can help you get what you’re owed.

- Unfair denial: If your claim is denied for reasons that don’t seem right, a professional advocate can help you fight back.

Remember, you're not in this alone. Dealing with a denied claim or a low settlement is incredibly frustrating. But knowing how to fight back can make all the difference. Be persistent, document everything thoroughly, and understand your options. These are your strongest tools. Don’t give up—a fair settlement is within your reach.

Your Roadmap To Claim Success

Filing a home insurance claim can feel like navigating a maze blindfolded. Trust me, I get it. But having a clear roadmap can make all the difference. Think of this as your trusted GPS, guiding you through the process, whether you're dealing with a burst pipe, fire damage, a break-in, or storm damage.

This isn't some generic checklist you'll find online. It's a practical framework built on real-world experience, designed to help you minimize stress and maximize your chances of a fair settlement. I've seen firsthand how important it is to be prepared.

Understanding the Timeline and Benchmarks

One of the biggest sources of frustration during a claim is unrealistic expectations. A simple claim for stolen goods might be resolved in a few weeks, while a major fire could take months. Here's what should happen to keep things moving smoothly:

- Prompt acknowledgement from your insurer: You should hear back within a few days after filing. If you don't, follow up!

- Timely adjuster visit: The adjuster should be out to assess the damage within a week or two, depending on the severity.

- Regular communication: Your claims representative should be keeping you in the loop. No news is not good news in this case.

Recognizing Red Flags

Just like your GPS warns you about traffic jams, there are red flags in the claims process. Watch out for these:

- Unresponsive adjuster: If your calls and emails go unanswered, it's time to escalate.

- Delayed payments: If payments are delayed without a good reason, something's not right.

- Lowball settlement offers: If the offer seems way too low compared to your estimated damages, get a second opinion. Don't be afraid to negotiate.

Knowing these warning signs can help you take action before things go completely sideways.

Staying Sane During a Stressful Time

Let's be honest, dealing with a claim can be emotionally draining. It's like running a marathon you didn't train for. Staying organized and informed is your best defense against stress. This roadmap will help you keep your sanity and make smart decisions.

Knowing When to Escalate and When to Be Patient

Patience is a virtue, but sometimes you need to be proactive. Knowing when to push for answers and when to give the process time to work is crucial. This framework helps you figure out the difference. It’s about knowing when a fair offer is on the table and when you need to fight for what you deserve.

A smooth and successful claim is possible. By understanding the process, being organized, and recognizing potential roadblocks, you can confidently navigate your claim and get the settlement you deserve. For personalized support in Oregon and Washington, NW Claims Management offers free claim evaluations. They can be your advocate in this often-complex process.