Understanding Today's Insurance Reality

Let's face it, dealing with property damage claims these days isn't a walk in the park. It's a whole different ballgame compared to what our parents experienced. Knowing what you're up against in the current insurance world is key to navigating this process successfully. Think of it like preparing for a major expedition – you wouldn't tackle something like climbing Mount Everest without understanding the terrain and potential obstacles, right? The same applies to filing an insurance claim; you need to understand the current insurance “landscape” before you even begin.

One of the biggest game-changers is the sheer number and intensity of catastrophic events we’re seeing. More hurricanes, wildfires, and other natural disasters mean insurance companies are dealing with a surge in claims and payouts. This has a direct impact on how they handle individual cases. They're under immense pressure to manage costs, which often leads to more scrutiny of each claim and potentially longer processing times.

On top of that, the insurance industry as a whole is facing profitability challenges. This translates into stricter claim assessments and a generally more cautious approach. Filing a property damage claim has become a more complex endeavor due to these rising costs and the frequency of catastrophic events.

To put this in perspective, let's look at some numbers. In the U.S., the average annual cost of home insurance jumped from $1,984 in 2021 to $2,277 in 2023, and projections suggest it could reach $2,522 by the end of 2024. This upward trend is fueled in part by extreme weather events like hurricanes and wildfires, which have resulted in a dramatic increase in insurance claims. Learn more about insurance trends here.

To further illustrate this point, take a look at the table below, which shows the trend of increasing insurance costs alongside the impact of major catastrophic events:

Property Insurance Cost Trends Over Time

| Year | Average Annual Cost | Catastrophic Events | Key Factors |

|---|---|---|---|

| 2021 | $1,984 | ||

| 2022 | 28 | ||

| 2023 | $2,277 | ||

| 2024 | $2,522 (projected) | 27 | Extreme weather, increased claims |

This table highlights the correlation between the increasing number and severity of catastrophic events, and the rising cost of insurance. This increased cost burden on insurers impacts how they handle claims, making meticulous documentation even more critical.

Building a Strong Foundation for Your Claim

Now, before you start thinking your claim is a lost cause, it's important to remember that being prepared and strategic can make all the difference. Knowing how to effectively file a claim in this current climate involves understanding the pressures insurers are facing. It's about presenting your case clearly and comprehensively right from the get-go.

Think of it like building a house – a solid foundation is essential. The same applies to your insurance claim. A well-documented, organized approach is your foundation for success. This is particularly important because many legitimate claims are denied not because of the actual damage, but because of inadequate documentation. Insurers are facing significant challenges in maintaining profitability, with some losing roughly five cents on every dollar of premium collected. This reinforces the need for property owners to be diligent and thorough in documenting their claims.

The Power of Proactive Record-Keeping

This new insurance reality underscores the importance of accurate and detailed record-keeping throughout the entire claims process. From your initial contact with your insurer to the final settlement, every single interaction and every piece of evidence matters. This proactive approach can significantly influence the outcome of your claim. Remember, knowledge is power. Understanding the challenges insurers face empowers you to navigate the system effectively and improves your chances of receiving a fair settlement.

Building an Unshakeable Documentation Foundation

This screenshot from the National Institute of Standards and Technology (NIST) website showcases their research on disaster and failure studies. Understanding the science behind how structures fail can be surprisingly helpful when you're documenting your own property damage. Their research really highlights how crucial detailed documentation is in understanding the cause and extent of the damage – a critical element in any successful claim.

Let's be honest: poor documentation sinks more legitimate property damage claims than anything else. It's like going to court without evidence. You might have the best case in the world, but without proof, you're probably going to lose. Let’s build a documentation strategy that will make your claim airtight.

This isn't about snapping a few quick pictures. It's about creating a comprehensive record that clearly tells the story of what happened and the resulting damage.

Photographing for Maximum Impact

Ditch the blurry, poorly lit photos. Your pictures need to be crystal clear, well-lit, and tell the whole story. Think like a detective gathering evidence at a crime scene.

Capture wide shots to establish the overall scene, then zoom in on the specific damage. For example, imagine a tree limb fell on your roof. You'd take photos of the entire tree, the spot where it hit your roof, and the damage inside your attic. Don’t forget to include a ruler or tape measure in close-up shots to provide a sense of scale.

Video can also be incredibly helpful. A slow pan across the damaged area can capture nuances that photos might miss. This is particularly useful for showing the extent of water damage or if a damaged structure has shifted.

Creating a Detailed Damage Inventory

Next up: the damage inventory. This is where you meticulously list every single damaged item. And I mean everything—from the obvious (like a shattered window) to the less obvious (like water damage to the flooring under a rug).

Be as specific as possible. Instead of "damaged sofa," describe the tear, the stains, any other problems. If you can, include brand names, model numbers, and when you bought the item. This detailed inventory becomes the backbone of your claim, justifying what you're asking for.

If this feels overwhelming, consider getting professional help. A public adjuster can be a lifesaver, assisting with both documentation and negotiating with the insurance company.

Organizing Your Evidence

Finally, don’t just toss all your documentation into a shoebox! Organize it logically. Create separate folders for photos, videos, receipts, and any emails or letters you exchange with your insurance company.

This organized approach shows the adjuster you’re serious and makes their job easier, which can only help you. A well-organized claim is a powerful claim. This attention to detail makes a strong impression and can significantly impact how quickly your claim is processed and, ultimately, how much you recover.

Mastering Your Initial Filing Strategy

Those first 48 hours after finding property damage can be a whirlwind. But the way you handle those first steps in filing a claim can really make or break the entire process. Think of it like building a house – a solid foundation is key. Let me share some insights on how seasoned claimants navigate this crucial period, turning potential disaster into a manageable process.

Making That First Call

First things first, grab your phone and call your insurance company. Have your policy number handy, along with the date and time the incident occurred and a short, sweet description of the damage. This isn't story time; just the facts. A clear statement like, "My roof was damaged in last night's storm," is much better than a long-winded explanation about the wind and downpour.

Ask them about their specific claims procedure and what you should do immediately. They might advise you, for example, to cover a damaged roof with a tarp to prevent further damage. This is where being proactive pays off. Documenting these preventative steps strengthens your claim significantly.

Preparing for the Adjuster's Visit

Think of the adjuster's visit like a job interview for your claim. You want to present yourself and your case in the best possible light. Get your ducks in a row. Organize all your documentation, including photos, videos, and your detailed damage inventory. Having a copy of your insurance policy on hand is also a smart move. It's important to understand the bigger picture here. The property and casualty insurance market, especially in the U.S., is huge. In fact, the U.S. has a 41% share of the global market, which is expected to hit $1.85 trillion by the end of 2024. Find more details about insurance market trends. Knowing this helps you understand the complexities of processing claims.

Try to anticipate the adjuster's questions and be ready to answer them clearly and concisely. Honesty is the best policy (no pun intended!). Exaggerating or making up damage will only hurt you in the long run. Consider it a joint investigation, not a battle. You and the adjuster are working together to assess the damage and figure out the next steps.

Setting Expectations and Avoiding Pitfalls

It's important to remember that claims take time. While you naturally want a quick resolution, rushing things can lead to errors. Clearly communicate your expectations to the insurance company and ask for a timeline for each stage of the process. Knowing what to expect can ease your mind and prevent unnecessary follow-up calls.

One of the biggest traps people fall into is making permanent repairs too soon. Temporary repairs to prevent further damage are crucial, but hold off on major repairs until the adjuster has seen the damage. Changing the scene before the adjuster arrives can jeopardize your claim.

Building Productive Adjuster Relationships

Your relationship with the insurance adjuster? It can seriously impact your property damage claim – sometimes even more than the actual damage itself. Think of it like a minor fender bender. Even if the damage is small, a bad interaction with the other driver can make things way worse. Same goes for dealing with adjusters. A good, professional relationship can smooth the whole process and potentially get you a fairer settlement.

Adjusters are often juggling tons of claims at once, working with tight deadlines and specific rules. Showing a little understanding for their workload goes a long way. Before they even arrive, get all your paperwork together. Think of it like having company over—you want everything ready so you can make the most of their visit.

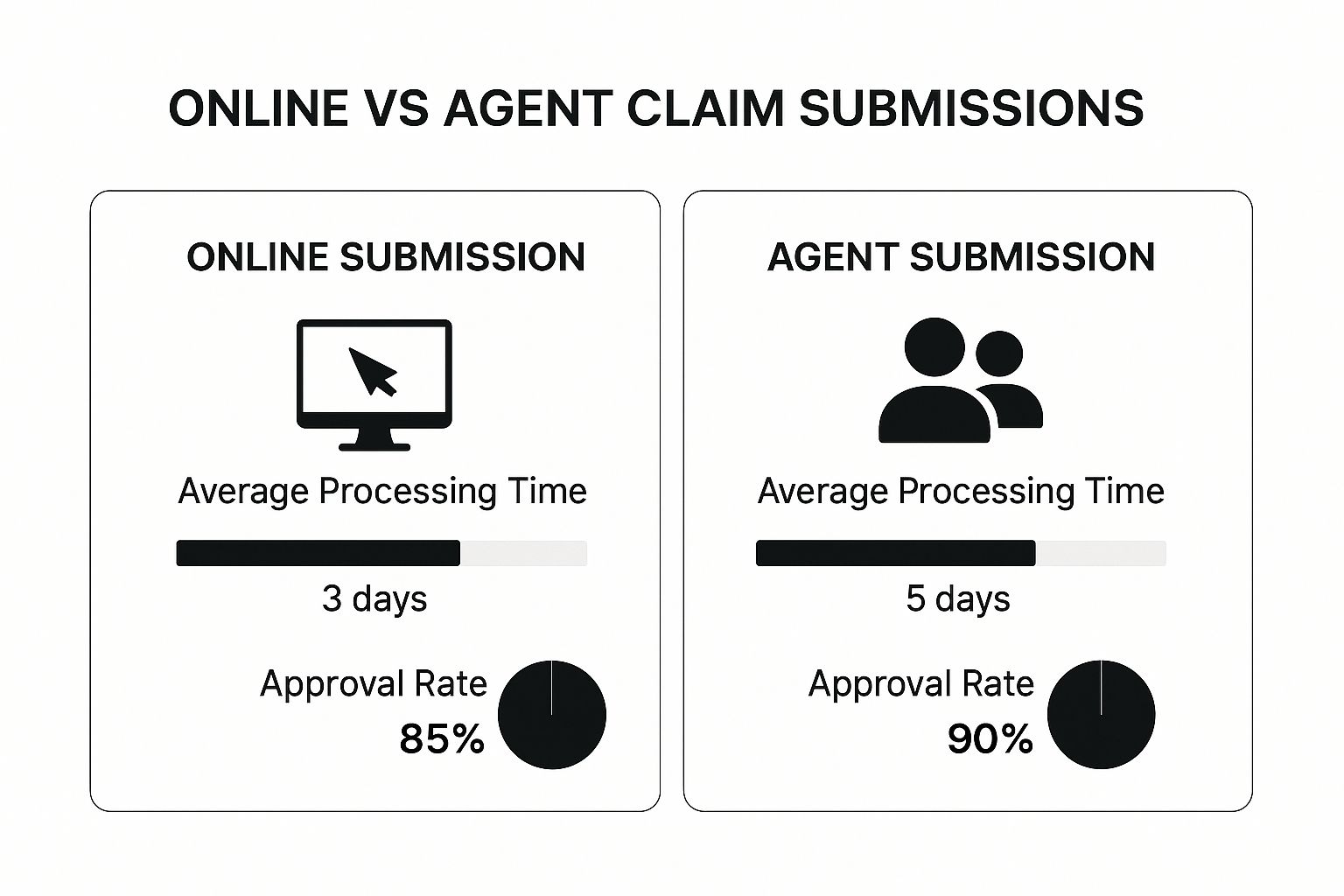

This infographic looks at online vs. agent-submitted claims, comparing processing time and approval rates. Online claims are faster (3 days average versus 5 days with an agent), but agent-submitted claims have a slightly better approval rate (90% versus 85% online). So, while online is quick, an agent’s personal touch might just give your claim that extra boost.

Communicating Effectively With Your Adjuster

During the adjuster's visit, clear communication is key. Give them everything they need: your detailed damage inventory, photos, all the documentation. Answer their questions completely and honestly. Remember, you’re both aiming for the same thing—assessing the damage and figuring out the next steps. It's a collaboration, not a fight.

Disagreements happen. If you hit a snag, stay professional. Avoid emotional reactions or accusations; stick to the facts and evidence. And document everything—every phone call, email, meeting. This creates a clear history of your conversations and protects you if disputes arise later.

Knowing when to hold your ground and when to compromise is tricky. But keeping things respectful is always the best strategy.

Here's a handy table to help you navigate these interactions:

Adjuster Communication Best Practices

Do's and don'ts for effective adjuster interactions throughout the claims process

| Situation | Recommended Action | What to Avoid | Expected Outcome |

|---|---|---|---|

| Initial contact with adjuster | Be polite and organized, have your claim number ready. | Being demanding or aggressive. | A positive first impression and a smoother start to the claims process. |

| Scheduling the inspection | Be flexible but confirm a time that works best for you to showcase all damage. | Missing the inspection or being unprepared. | A thorough inspection and accurate assessment of the damage. |

| During the inspection | Clearly explain the damage and answer questions honestly. Provide supporting documentation. | Exaggerating the damage or withholding information. | Adjuster gains a clear understanding of the extent of damage. |

| Follow-up communication | Be proactive, follow up on outstanding questions or documents. | Being impatient or pestering the adjuster excessively. | Keeps the process moving forward and demonstrates your commitment. |

| Negotiation | Be prepared to negotiate but stay reasonable. | Being overly aggressive or unwilling to compromise. | A fair settlement that reflects the actual damage. |

This table summarizes some key points for communicating effectively with your adjuster, leading to a smoother claims process and, hopefully, a fair settlement.

Getting Professional Help

Sometimes, navigating these complex relationships and ensuring a fair settlement requires a little extra help. Consider contacting a professional claims management service like NW Claims Management. They're experts in advocating for policyholders and can provide valuable support during a potentially stressful time.

Negotiating Settlements With Confidence

So, that initial settlement offer lands in your inbox. Maybe it's close to what you expected. More likely, it feels underwhelming. I get it. It’s a common reaction. Many people either panic or reluctantly accept less than they deserve. But here’s the insider tip: negotiating a property damage claim settlement is a process. It’s not a one-and-done deal. Think of experienced negotiators: they approach these situations with a clear strategy and a level head. Let me show you how you can do the same.

Identifying Lowball Offers

How do you know if you're being lowballed? Start by comparing the offer to your detailed damage inventory and repair estimates. Does it cover everything? Are the amounts reasonable considering current market prices for materials and labor? I’ve seen offers that completely miss entire sections of damage, or use material prices from five years ago! If something feels off, it's time to push back. Remember, insurance companies are businesses. Their initial offer is often designed to minimize their payout, not necessarily to fully compensate you for your losses.

Gathering Compelling Evidence

Challenging a low offer requires rock-solid evidence. This is where your meticulous documentation from the beginning becomes invaluable. Those high-quality photos, videos, and your detailed damage inventory are your best friends in this process. I had a case where the insurance company disputed the extent of water damage behind a wall. Luckily, my client had a video showing soaked insulation. That video single-handedly changed the course of the negotiations.

Sometimes, getting independent estimates from contractors can make all the difference. They provide unbiased assessments of the damage and necessary repairs, adding serious weight to your negotiating position. This is especially true if the insurance company’s estimate seems suspiciously low.

Presenting a Persuasive Case

Negotiating is about clear communication and presenting a logical, persuasive argument. Explain why you believe the initial offer is insufficient, referencing your documentation and contractor estimates. Don't think of it as arguing, but as presenting facts and figures. For commercial property owners, navigating these claims can be even more complex, so check out these additional resources to help you through it: You might be interested in our commercial claims resources.

It's worth noting that customer satisfaction with property insurance claims has been declining, largely due to increasing premiums and long repair times. A 2025 J.D. Power study found that claimants wait an average of 44 days for final payment after reporting a loss. Discover more insights on claim satisfaction. This highlights the need for open communication and efficient claim processing between insurers and policyholders.

Handling Partial Denials and Persistent Advocacy

Sometimes, you’ll receive a partial denial. Don’t panic! Carefully review the denial letter to understand exactly what they’re disputing and why. Then, gather the evidence to counter their arguments. For example, they might deny coverage for a specific item, claiming it wasn’t damaged by the covered event. This is where those detailed photos come in handy. Persistence and polite, professional advocacy are key.

Negotiating a fair settlement often involves some back and forth. Be prepared to compromise on some points while holding firm on others. Remember, the goal is a resolution that adequately compensates you for your losses while maintaining a professional relationship with your insurer. It's a balancing act, but with preparation and a clear strategy, you can navigate this process with confidence and secure the settlement you deserve.

Avoiding the Pitfalls That Derail Claims

It’s one thing to have a legitimate property damage claim. It’s another thing entirely to actually get what you’re entitled to. Even with the best of intentions, I've seen property owners accidentally sabotage their claims through seemingly small mistakes. These range from casual social media posts about the incident (which, believe it or not, can sometimes contradict your official claim) to prematurely making repairs that erase key evidence. Let's talk about some of the most common errors experienced adjusters see, and how you can avoid them.

Common Claim Killers

One major pitfall is simply not understanding your policy. Those little policy details, like not keeping up with routine maintenance or storing certain materials improperly, can completely void your coverage. It’s so important to really know what your policy covers, and even more importantly, what it doesn't. I can't stress that enough.

Then there's the issue of timing. Missing deadlines for filing your claim or getting required documentation in can cause major delays. Think of it like missing a flight; a few minutes can throw your entire trip off. Similarly, missing insurer deadlines can seriously impact your claim.

And don't underestimate the importance of communication. Not keeping a record of every interaction with your insurer, or giving inconsistent information, can turn a straightforward claim into a long, drawn-out battle. Clear and consistent communication is absolutely paramount.

Navigating the Nuances of Claims

This screenshot from the Insurance Information Institute (III) website gives you a snapshot of various insurance facts and stats. You can see how many homeowners and renters actually have insurance, which puts your own claim into perspective. It's helpful to understand this bigger picture as you navigate your own situation.

Also, be aware of “red flags” that can make your insurer take a closer look at your claim. Big differences between your initial claim and later estimates, or inconsistencies in your account of what happened, can raise red flags. While you should definitely advocate for yourself, make sure all your information is accurate and consistent.

Avoiding Needless Complications

You can avoid many of these claim-killing mistakes through careful documentation and clear, proactive communication. For those dealing with government or non-profit claims, resources like the NW Claims Management guide on government and non-profit claims can be incredibly helpful.

The bottom line is to present yourself as a credible, organized claimant. By understanding and avoiding these common pitfalls, you dramatically improve your chances of a smooth and successful claim. Being proactive and informed keeps your claim on track, reduces stress, and ultimately increases your chances of a fair settlement.

Your Complete Action Plan For Success

So, we've talked a lot about filing a property damage claim. Now, let's map out a practical plan you can follow, from the moment you discover damage to that final settlement check. Think of it as your personal GPS for navigating the often-confusing world of insurance claims.

Initial Steps: Documenting and Reporting

First things first: documentation is key. When you find damage, immediately document everything. Photos, videos, detailed descriptions – the more the better. Remember that example we talked about earlier with the tree limb? Documenting the surrounding area, the impact point, and the resulting internal damage can make a huge difference in how smoothly your claim goes. Then, report the damage to your insurance company as soon as possible. Have your policy number handy and give them a brief summary of what happened. This initial contact sets the tone for the entire process.

It’s kind of like setting the foundation for a house. You want it to be solid and accurate from the start. Rushing this step can lead to problems later on.

Working With The Adjuster

Next, you'll meet with the adjuster. Be prepared for their visit like you're expecting a VIP. Have all your documentation organized, anticipate their questions, and be ready to show them the damage. Think of the adjuster as an investigator; your job is to make their job as easy as possible. Clear, respectful communication can really go a long way. For more helpful tips, check out other articles on our blog: Read also: Other helpful articles related to the claims process.

I’ve found that offering the adjuster a cup of coffee or a bottle of water can create a more relaxed atmosphere. It might seem like a small thing, but little gestures of courtesy can make a big difference.

Negotiating and Settling Your Claim

When you get that settlement offer, don’t just accept it without thinking. Carefully compare it to your damage inventory and any contractor estimates you’ve received. If it seems low, don't be afraid to negotiate. This is where having detailed documentation really pays off. Be ready to back up your position with evidence and present a clear, logical argument for a fair settlement. Remember, you have the right to stand up for yourself.

One time, an insurance company offered me a settlement that was significantly lower than my contractor’s estimate. Because I had meticulously documented everything, I was able to successfully negotiate a much fairer settlement.

Staying On Track and Getting Help

Throughout this process, stay organized and document everything. Keep copies of all letters, emails, notes from phone calls, and any other evidence you collect. This creates a clear record of your claim's progress and protects you. If you’re feeling lost or unsure about anything, think about contacting a public adjuster. They’re pros at handling these situations and can provide valuable guidance.

A public adjuster is like having a seasoned guide in unfamiliar territory. They know the ins and outs of the claims process and can help you get the best possible outcome.

Ready to take charge of your property damage claim and get the settlement you deserve? Contact NW Claims Management today for a free consultation. We’re here to help you through every step and ensure you get a fair and quick resolution. Get your free claim evaluation now!